Saving for your first home is a huge milestone. One of the best things that working hard can do for you is allow you to purchase a home. No apartments, no renting, an actual home! Purchasing a home is a big deal, and comes with a lot of extra costs that you aren’t used to. Your first home is likely a long-term investment. The CGS Team is sharing a few strategies when it comes to saving for your first home. You can save yourself a lot of money by prepping and saving strategically before you make the purchase.

Saving for your first home…

Pay Down Your Debt

A mortgage is a debt. A secured, long-term debt, but a debt no less. This means in order to qualify to take on this debt, your credit has to be up to par. The first step in saving for your first home is paying down your debts.

If you have too much debt compared to your income, you may not even qualify for a home, or you could be stuck with an unnecessarily high-interest rate. Focus on paying down your debts so that they total less than 30% of your total available credit. This will significantly increase your score, and help you understand your buying power.

Check Your Buying Power

Once your debts are under control and your credit score is in the “good” range, check your buying power. This process consists of reaching out to a reputable lender to see how much of a loan you will qualify for. The loan amount you qualify for gives you an idea of what kind of price range you can start looking for.

To see the amount of the loan you qualify for, the lender does have to run your credit. You are not required to move forward in the process, which is great. Once you know the loan amount, you can start estimating other costs associated with home-buying. Read 5 Tips for First Time Home Buyers for more details.

Estimate the Costs of the Initial Purchase

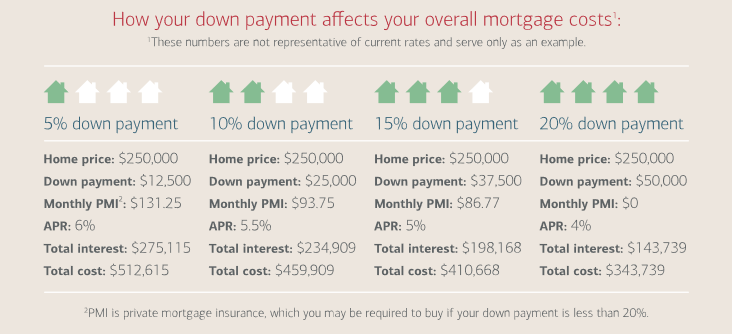

Will you be putting a 20% down payment on the home? If not, you will likely be required to purchase PMI (private mortgage insurance), which can increase your monthly mortgage payment amount. Down payments typically start at 5% and go up from there, depending on the type of loan you qualify for. Here are some other costs associated with the purchase:

- Closing costs (3%-7% of the purchase price)

- Moving expenses from your current living space to your new home

- Costs of repairs and renovations (painting, new appliances, etc.)

- Potential new furniture and décor costs

When you have the estimated amounts for the items above determined, plus the down payment amount you want to have, you can calculate how much you actually need to save before moving forward. Once you have that savings amount, get to work! Get yourself set up on a budget plan and do your best to keep your current costs low while saving.

Understand How Interest Affects You

Check out the graphic below (courtesy of Bank of America and Better Money Habits) to see how interest can affect you. This may make you think twice on the down payment amount you want to save for.

Related: The Home-Buyer’s Checklist

Have you started saving for your first home? Do you know what loan amount you qualify for? What are your thoughts, fears and experiences when it comes to planning and saving for your first home? We want to hear your thoughts! Post a reply comment below to share!

3 thoughts on “4 Tips For Saving for Your First Home”

helpful article!! but also now is the time to invest given that the interest rates are really low.

I’m with @Marjory-elizabet the economy has come a long way since the housing market crash a few years back. If you have the savings and a good credit score, take advantage. My brother and I recently refinanced our rental property for a lower rate and we were able to charge more for rent, even with the lower mortgage payment!

That’s awesome! Investing in real state is never a bad investment. I’m in the process of buying a house and was able to get the first owners loan and the mortgage rates are not bad at all.

Hopefully in a few years i can invest in more 🙂