We’ve provided an overview of credit reports and credit scores in the Finance 101: Credit Reports and Scores article; and most recently we have shared tips for improving your score in the 7 Tips to Help Boost Your Credit Scores article. Today, we are sharing with CGS members a full breakdown of how your credit score is calculated. We are getting into the nitty-gritty of each category that determines your score. The best way to improve your score is to understand it. Knowing the importance (and rating) of each category can help you take the appropriate actions to raise your score.

Credit scores broken down…

Credit Score Ranges

According to credit.com, most credit scores operate within the range of 301-850. Within that range, there are different categories:

- Excellent Credit: 781 – 850

- Good Credit: 661-780

- Fair Credit: 601-660

- Poor Credit: 501-600

- Bad Credit: below 500

While these categories are usually standard, some lenders may have their own definitions of what is considered a good or bad score. Unfortunately, you won’t know for sure until you apply for credit with a specific lender. However, the better your score, the better your interest rates and borrowing power.

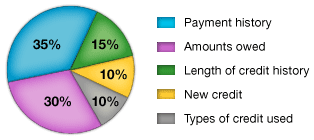

The chart above shows the current breakdown of a person’s credit score. This breakdown is used by each of the credit bureaus, with slight variations. This will explain the slight difference in score amounts. So now that you have the full breakdown, let’s get into each category!

Payment History (35%)

Clearly, payment history is the most important factor in determining your credit score. This category tracks payments that were short of the minimum balance, sent in late, or not paid at all (and/or sent to collections). What’s great about this category is that it is completely controllable by the borrower. Making payments on time and paying at least the minimums will keep this category healthy. Paying late or less than the minimum due can result and a largely negative skew in your score.

Debt/Amounts Owed (30%)

Another important category, the debt/amounts owed is calculated by comparing your total debt to your total available credit. For example, if you have 3 credit cards with a total credit limit of $10,000 then that is your total available credit amount. If you are using $8,000 of the total $10,000, your debt to credit available amount is 80%. Most credit companies recommend keeping the % of debt used to under 30%.

One thing to keep in mind is that installment loans are slightly different in this category. Since loans are already used credit, it’s not calculated the same as credit cards. It’s extremely important to also pay down your loans as they will accrue interest and generally have higher debt balances.

Length of Credit History (15%)

Starting to establish good credit habits at a young age is extremely important. Since the average length of credit history is 15% of your score, the longer you have established credit, the better. To excel in this category, most credit rating companies recommend credit that’s been open for an average of 10 or more years.

That’s why it is best to start young. When you start building your credit at a young age, you set your future-self up for better rates in the future. A low risk suggestion for high school or college students is to get a low-balance, low-rate student credit card. Most major banks and credit card companies offer these to people who have no credit history. Remember, if you start establishing credit, make sure you are always paying timely!

New Credit & Inquiries (10%)

Every time you apply for credit it dings your score a few points. That ding could stay on your report for up to 6 months, even if the credit is denied or not accepted. Too many inquiries in a short amount of time could signal to lenders that you are short on cash and desperate for credit. Also, each time you establish new credit, you are bringing down your average length of credit history. Be cautious with this category, and space out your attempts for new credit.

Types of Credit Used (10%)

The last category used to determine your credit score is the types of credit you have. Having a mix of different types of credit (and paying diligently) shows lenders that you are responsible with credit across various platforms. Having a small amount of credit cards, mixed with 1 or 2 installment loans shows variety. Mortgages are also a benefit in this category.

Related: How to Read Your Credit Report.

There you have it! We shared a full breakdown of your credit score. Make credit decisions based on the categories above. Be smart with your credit and it will certainly show in your credit score. Do you have any questions regarding the credit score categories? Care to share any tips that help you stay on top of your credit? Leave a comment below and let’s chat!

5 thoughts on “Credit Scores Broken Down”

Hey ladies! @clara-i-soriano @sltrysngr @noelia-tejada @kamwaroms @lydiajohnson Check out the new post “Your Credit Score Broken Down” for great information on how your credit score is calculated!

I love that the largest category is completely controllable. That makes it easier for those who are really trying to improve their scores. Great information in this post!

Great read. I really like the breakdown of each section and the explanation of the weight that each category has on your score. It highlights different area that you can work on

Very informative article. I had never seen how each item was weighted towards a total score previously. Thank you

Thank you @missjocelynmarie We are happy to have provided you with more insight! 🙂