You learned all about how credit scores are calculated in the Finance 101: Credit Reports and Credit Scores article, but the most important question is how can you help raise your credit scores? Since there are specific categories and ratios used to calculate your score, the trick to raising your scores is to focus your efforts on succeeding in each category.

The CGS Team is sharing 7 tips to help you nail each category, as best you can, and eventually give your credit scores a boost. Remember, increasing your credit scores can take time, so don’t get discouraged. Set a goal to boost your credit scores, and let these tips help serve as action plans to get there!

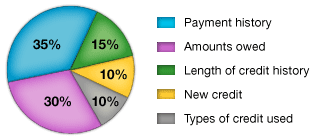

Before we get started, we mentioned that your credit score is based on certain categories. Take a look at the chart below (courtesy of myFico) to familiarize yourself with how the credit bureaus actually calculate your score. Understanding these calculations will help ensure you focus on what is truly important when increasing your scores.

Tips for Payment History

Since your payment history is the largest factor and accounts for 35% of your score, focusing on this category should be your first priority. Missed or late payments can hurt your score more than any of the other categories, so here are some tips to keep you on track:

1. Set up Automatic Bill Pay – Since making late payments can lower your credit score, put yourself in a position to never let that happen. Setting up automatic bill pay (most banks offer this complimentary with their accounts), will help alleviate the stress of keeping up with multiple due dates. Letting your payments get taken care of automatically can allow you to focus on other things. Set up account alerts to let you know when your balance reaches a certain point. Negligence in this area can cause payments to be missed completely.

2. Pay off Past Due Accounts – If you currently have accounts in collections or with multiple payments past due, pay these off immediately. The longer these accounts sit in late or missed status, the more damage is done to your credit score. If you can’t pay them off completely, contact the creditors to see if they will accept a payment plan. This may not help your score, but at least letting them know can prevent more issues down the line.

Tips for Amounts Owed

Your amounts owed history makes up 30% of your credit score, making it the second largest category that the credit bureaus look at. Some people have the ability to always pay on time, but the balance on their cards gets out of control. Here are some tips to try when working on your amounts owed:

1. Keep Your Balances Low – According to Experian, your score can be negatively impacted if you owe debt that equals or exceeds 30% of your available credit for ALL debt. To put that into perspective. If you have 1 credit card with a credit limit of $3000, another with a credit limit of $500, and one more with a limit of $2500, then your total available credit equals $6000 ($3000+$500+$2500).

If you have balances of $2200, $125, and $1750, totaling $4075; then you are using nearly 68% of your available credit (4075/6000). If your expenses exceed your income, it is very easy to use over 30% of your available credit. Avoid using your cards at all costs, and if you can pay down your balances (and keep them down), then get it done!

2. Budget for Debt – If the amount owed on all of your cards is over 30%, then create a budget plan that lets you focus your energy on tackling debt. Any extra money that comes in should automatically go as extra credit card payments. Let the CGS Team help! Check out the CGS Personalized Budget Portfolios which offer debt repayment plans to help you allocate your income the best way possible to reduce debt.

3. Don’t Open More Accounts Just to Increase Your Available Credit – While this may seem like a good alternative to offsetting your available credit percentage, it can certainly backfire on you. Yes, you may be increasing your available credit, but you are also getting hits on your score from the lenders who have to check your credit. Also, this decreases your average length of credit history, which also impacts your score.

Tips for Length of Credit History

The longer you have credit, the better for your credit scores. We aren’t talking 3 or 4 years either. Accounts that have been opened 10 years or more are great for your score. Unfortunately, anything less than that can be considered “new” and may negatively impact your score. Since there isn’t much you can do to change how you started your credit journey, you can do something to help keep your average length of credit history as high as possible:

1. Avoid Opening Too Many Accounts All At Once – The length of your credit history is an average of the amount of time each credit account has been opened. So if you have 1 card you opened 7 years ago, another opened 3 years ago, and 2 accounts opened 1 year ago, your average length of credit history is 3 years. Considering that you have an account that is 7 years old, that may not make you feel great. What is bringing your average down is the 2 accounts opened 1 year ago. Space out your new accounts as much as possible. Opening too many account too quickly can bring that average down fast.

An Important Tip for Anyone Working to Fix Their Credit

Always check your credit report! You are entitled to one free credit report every year. Make sure that you are fully abusing this! This will give you the opportunity to spot any fraud or identity theft issues, as well as confirm that all your hard work for paying your bills on time is paying off. If you find something on your report that shouldn’t be there, check out the How to Fix a Faulty Credit Report article to figure out what you need to do next.

Repairing your credit takes time, energy and determination. Don’t get discouraged if you don’t see results as quickly as you want. The steps you take now will have a great impact on your future credit scores! Do you have any tips that helped you get out of debt or fix your credit? Please share with CGS and the community, so that others may learn! Leave a comment below to share!