This Finance 101 topic is an overview of credit reports and credit scores. We all know that credit is a crucial part of anyone’s life. Without proper credit, you will struggle to obtain things such as houses, cars and college education.

Understanding how and where your credit is tracked is the first step to having good credit. The CGS Team will help you understand how credit reports and credit scores really work.

Credit Report Basics

What is a Credit Report?

According to Investopedia, a credit report is “a detailed report of an individual’s credit history prepared by a credit bureau and used by a lender in determining a loan applicant’s creditworthiness.” In other words, a credit report contains information about you, your credit and payment history.

This can include personal information, how often you make timely payments, how much credit you have available, accounts past due or in collections, and public record information including liens, judgments, wage garnishments, and bankruptcies.

A credit report may also contain rental repayment information if you are a property renter.

What Information Does a Credit Report Track?

Personal information including your current or recent addresses, current and previous employers, your SSN, DOB, and your name.

Credit history includes the length of your credit accounts, current credit limits, current payment terms and balances, and payment history.

Credit report inquiries are also tracked. These inquiries include any lender, service provider, landlord or insurer who has checked your report to determine your credit worthiness.

How Does the Information Get on My Credit Report?

Creditors forward monthly updated balances, newly opened accounts, and credit applications to the credit reporting agencies (Experian, Equifax and TransUnion).

How Long Does the Information Stay on My Credit Report?

The length of time information stays on your credit report varies by the type of data. Open and current credit accounts remain on your credit report until closed. Once an account is closed, it may stay on your report for 7 to 11 years from the date of last activity.

Credit inquiries remain on your credit report for up to 2 years. Public record information including liens, bankruptcy, foreclosure, and more stay on your report for 7 years.

If something doesn’t belong on your report, read How to Fix a Faulty Credit Report.

Where Can I See My Credit Report?

You are entitled to a free credit report from each of the credit reporting agencies once every 12 months.

Download a copy of your report for free at www.annualcreditreport.com or use credit-monitoring sites such as www.creditkarma.com and www.privacyguard.com who provide your credit report monthly for a fee.

For more information on credit reports, visit the Consumer Financial Protection Bureau’s website at www.consumerfinance.gov.

Credit Score

What is a Credit Score?

A credit score is a three digit number ranging from 300-850 generated by an algorithm using information from your credit report.

“It’s designed to predict risk, specifically, the likelihood that you will become seriously delinquent on your credit obligations in the 24 months after scoring,” according to Bankrate.

Each of the three credit reporting agencies generate a credit score (Equifax, Experian, TransUnion). A good credit score is generally considered to be 720 or higher.

How is a Credit Score Different from a Credit Report?

Your credit score is the actual numerical value based on the information found on your credit report. You cannot have one without the other.

How is My Credit Score Calculated?

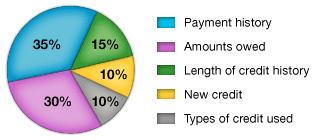

There are five categories that inform your credit score: payment history, amounts owed, length of credit history, new credit, and types of credit used. Each category represents a specific percentage of your score.

The chart below from myFICO.com best portrays the importance of each category.

What Affects My Credit Score?

There are many factors that affect your credit score. Late payments, accounts in collections, and owing more debt than you have available credit all affect your score.

The length of your credit history also affects your score. The more “good” credit history you have, the better your score will be.

Typically, applying for credit more than 2 times within a one year span will lower your credit score slightly.

Lastly, to have the best score, you should have a mix of credit types. Mixing between installment accounts, such as loans, real estate accounts, and revolving credit, such as credit cards, will help promote the best score.

Does your credit score need a boost? Check out our 7 tips to help raise your credit score.

Where Can I See My Credit Score?

Unlike a credit report, consumers are not entitled to an annual free credit score. To see your credit scores, you have to purchase it from a credit monitoring company, such as www.myfico.com, or from the three reporting agencies.

Related: 5 Ways to Manage Credit Like a Pro

There is an endless amount of information out there to help you understand credit and everything that comes with it. Don’t be afraid to do research and learn all you can.

Do you check your credit report and score annually? Share your experience with credit reports with the community by leaving a comment below.

4 thoughts on “Finance 101: Credit Reports & Credit Scores”

I use Privacy Guard which allows me to see my credit report each month, as well as track changes in my score. I pay a monthly fee, but since I am trying to keep my credit high it is worth it!

I track my credit score through my bank. Understanding how to build credit and track your credit score is important. Having good credit makes life so much easier and opens so many doors.

I never knew how important credit was until I reached adulthood! Unfortunately, schools and parents don’t touch on credit as much as they should! With the help of CGS, I am learning about the different ways to read and monitor my credit! I would love to read on ways to improve my credit score as well! Any suggestions?

Credit Karma is a good way to track your debts and credit score at no cost.