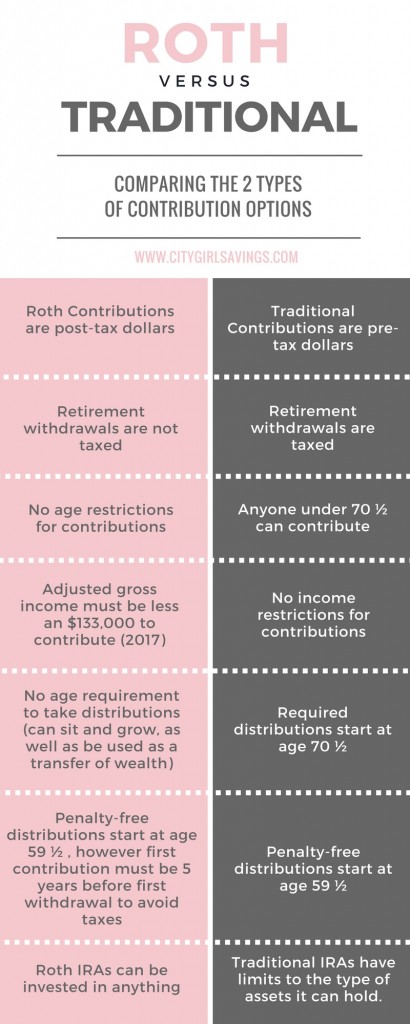

When it comes to your retirement savings, specifically your IRA, you have two options on how you’d like to contribute. You can contribute to a Roth IRA or a Traditional IRA. 401k plans through your employer also have the option of a Roth or Traditional, but not all companies make that option available to their employees. So that you can be as knowledgeable as possible with your retirement savings, the CGS Team is breaking down the difference between Roth and Traditional forms of retirement savings. Check the infographic below for the major differences.

Your Retirement Savings

So how do you know which plan is right for you? It all depends on how you think your income will change in the future. Do you expect to be making more (and therefore paying more in taxes) as you age? Maybe you plan on having investment properties, business income, etc. If you plan on making more as you age, getting the taxes of your retirement plan out of the way now may be the best route.

If you plan on living a simple life during retirement and don’t expect much income outside of your retirement distributions, you can take the tax break now (since pre-tax contributions lower your current gross income) and pay the taxes at a lower bracket when you retire.

If you’re not sure, think about what history shows. According to rothira.com, “Given today’s historically low federal tax rates and the large U.S. deficit, many economists believe federal income tax rates will rise in the future – meaning Roth IRAs may be the better long-term choice. But of course, no one knows.” If you can afford to pay the taxes now, why not?

Are you contributing to a Roth or Traditional IRA or 401k? How did you determine the best route for you? Leave a comment below to share your thoughts!

2 thoughts on “Retirement Savings: Roth vs Traditional”

I do Roth contributions, primarily because I believe I will be in a larger tax bracket when I retire. Not too mention, I’d rather get the taxes out of the way now.

topics like this can be intimidating, but the more i read on it the more comfortable i get about how i want to save for my future. There is so much that goes into investing!!