As you may already know or have experienced, when it comes to getting a new car, house, or apartment, you have two options: leasing and owning. You can lease a car for your agreed term, or you can purchase a car with (or without) financing.

Leasing vs. Renting

Typically apartments are usually rented out, but in major cities like New York City and Los Angeles, floors or suites of the apartment building can be purchased. The CGS Team wants to ensure that you are knowledgeable of the advantages and disadvantages of owning or leasing.

Understanding your own financial situation and knowing the best option for you will pay off in the end. So let’s get into it!

Cars

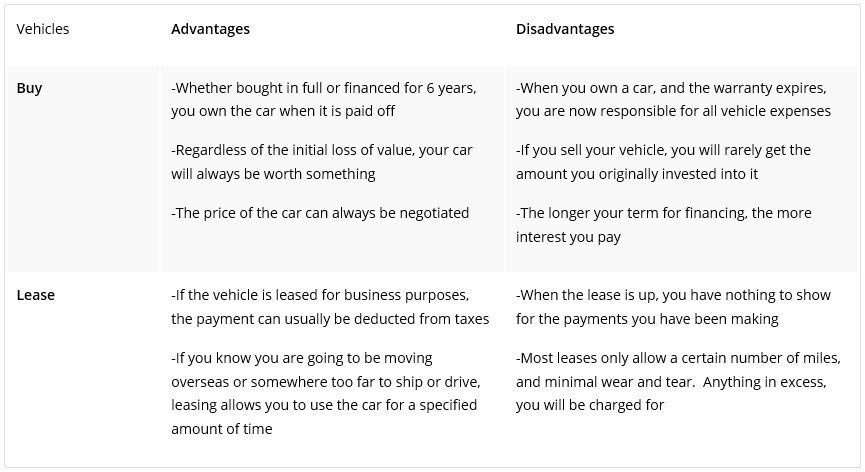

Unless you live in a city with an endless supply of transportation, a car is usually a must-have for anyone. Having a vehicle allows you to get to work, school, and every day activities without hassle or concern. When looking for a new (or used) car, knowing when to lease or purchase is crucial.

An interesting fact about cars is that if they are purchased brand new, they usually lose 20-30% of their value within the first year. That’s a significant loss of your money, especially depending on the price of your car.

However, regardless of the value, you will still own the vehicle. Check out the table below for the advantages and disadvantages of leasing or purchasing a car.

Although there are advantages to leasing a vehicle, the financially savvy move is to buy a car; buying the car slightly used, will put you in the best financial situation in the end.

Houses

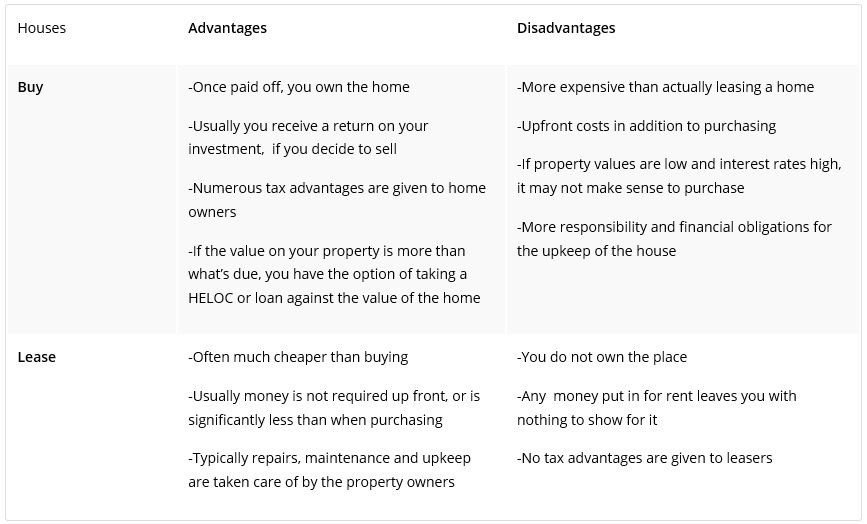

It doesn’t matter who you are, you will always need a roof over your head. Having a house or apartment is an essential part of life, and unless you want to live with your parents forever, it is a necessity.

You have the option of renting a house or apartment, or purchasing outright. Unlike cars, houses are designed to gain value over time. This can leave you with more money than you originally put into it!

However, depending on your current financial situation, purchasing outright may be too much right now. There are still benefits to leasing a house though, review the table below for the advantages and disadvantages of leasing or purchasing a house.

Similar to vehicles, it makes more financial sense to purchase a house than to rent or lease it (that includes apartments as well). If you are not there financially, don’t worry.

Renting for a specific amount of a time can allow you to save for a down payment on your own place. It is a sacrifice that most young adults make, and it is perfectly normal.

Related: 6 Unexpected Costs that Come with Owning a Home

If you are in the market for a new home or car, make sure you do your research. Know exactly what you are willing to spend and work from there. Familiarize yourself with current market and interest rates, review all of your options and don’t be afraid to negotiate the price.

You want to feel good about your purchase (or lease), and the only way to do that is to stay within your means.

Are you contemplating buying or leasing a new car or home? Have you purchased or leased a car or home in the past? Share your experiences with the community by leaving a comment below. We can all learn from each other’s feedback!

4 thoughts on “Leasing vs. Owning: Know Your Options”

I think I would prefer to own a house and car. Although there are some benefits to leasing, nothing beats having something that is all yours!

Yes I agree. I think renting is more convenient at times but then on the other hand I think of all of the money I’m using to lease a place when I could be investing in something of my own.

Thanks for sharing this article. I love it.

Thanks for sharing the great content..