Daniella’s Finance Journey outlines the financial experiences that CGS member @daniellacoin is going through as she works with the CGS Financial Consultant to get on financial track. Daniella has graciously offered to share her journey to help inspire and motivate others to take control of their financial lives!

Daniella’s Share:

I’m reading my blog from the beginning so far and seeing the journey has been fun. I cringe at how honest I am about being broke sometimes because that is not something that I am proud of in the least. I just realized I get paid on Friday, and for the first time IN MY LIFE I am not in desperate need. I am not trying to hold on to my last few dollars and make it to pay day. So, CGS Community, I am not living paycheck to paycheck anymore!

Let’s talk about a milestone. It gets hard for me to say no, especially when it’s something that I actually want. I was at a Becca event in an Ulta near me. After the girls cooed all over my clear skin they went to work packing on the expensive products. (I can totally do a skin care blog with affordable products for you guys! Comment below if you want it!) Now, I LOVE makeup and I technically have the money to buy a ton of makeup now and be broke and sad later. I decided to match my friend’s budget of $30 for products. When they were done with my face and asking me if I liked any of the products I asked for the eyebrow product because I ran out.

I came there with knowledge of what I actually needed to replace because I have a vanity filled with products. They unfortunately sold the last of the brow product and I had to gracefully back out. It really helped that I was there with my friend so I didn’t feel overwhelmed and guilty to purchase something. So I walked away. (I do not have an iron will and I purchased one thing I needed, which was mascara and some I didn’t, like face masks, and spent $29.48. I mean, its progress right? Rome was not built in a day, don’t judge me.) This is something I will have to work on in general. The idea of maximizing your dollar is a common concept but hard in practice. Above all, my general issue isn’t knowledge, its discipline.

There is a lot of room for improvement. I realize that socializing is going to be harder than I thought. My receipts are still a mess, and I am not proud of it. I will say that I understand why I need to track them because I lost track and cannot tell you how much I may have overspent by. I’m also unsure of when I hit my cap. This makes me feel a little overwhelmed and out of control. So tonight before I freefall into poor spending, I’m going to try to right myself again. I like that I am not irresponsibly poor this week, but bills are coming up and week one of my debt plan is starting this upcoming paycheck.

Comment below, what is an area you need improvement on? Also do you want to know my skin care products I love under $10 or what high end products I love that are worth the investment? Hint, I may have one of the 24K Gold face masks the beauty community raves about. I want to hear from you!

Regards,

Daniella

About Daniella…

Daniella is a 25 year old working millennial living in Dallas, TX. Daniella is originally from New York and has moved to Dallas to start a life of adulthood on her own. She currently works as an administrative assistant and has a passion for make-up! Feel free to leave a comment with any thoughts or questions for Daniella.

3 thoughts on “Daniella’s Finance Journey: Week 5”

Good Morning ladies! @lena @katie-gessell @jen-lunde @rvlry @carlyhagemann @jpmachuca @jascadel @owithers135 @jlana985 Have you been following Daniella’s finance journey? Great progress is being made!

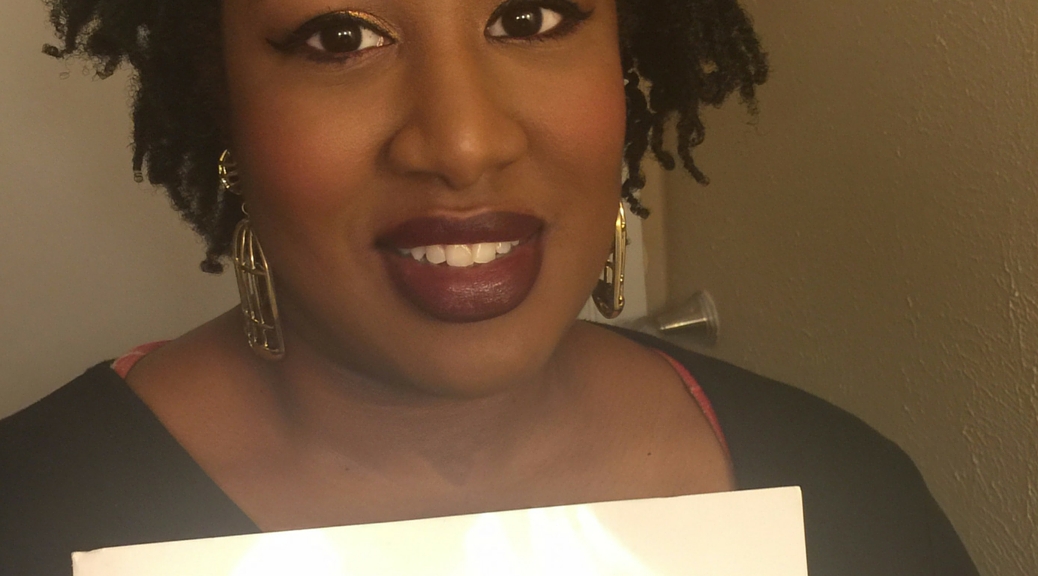

I love your honesty! Thanks for sharing with us and of course your makeup looks flawless ? @daniellacoin

Thank you!!! i STRUGGLED to get a good picture. Appreciate!