There’s no doubt in my mind that you already know that investing is one of the best ways to build true wealth. What most people don’t know is how to go about investing. The good news is that the availability for anyone to invest is better now than it’s ever been. There are so many free platforms to get you going.

While I can go on and on about how you can get started with investing, I want to make sure you understand why you shouldn’t wait to get started. I’m sharing 6 reasons to start investing next year, so you can make it a top priority!

Reasons to Start Investing Next Year

#1 – The earlier you start investing, the less you’ll need to invest to reach your goals

Here’s one of the great things about investing – the earlier you start, the less you’ll need to invest each month to make a lot of money over time. That’s because of the power of compounding interest. Interest compounds over time more than it does over large amounts.

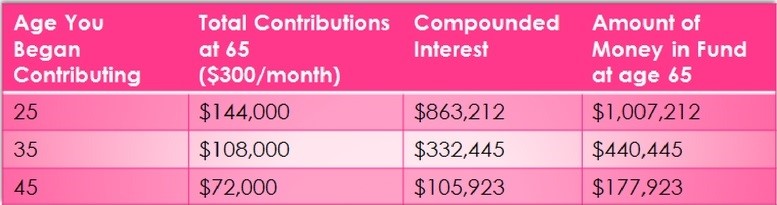

In the article 8 Ways to Set Yourself Up for Financial Success, I break this down in a chart. Basically, the chart shows that a person who starts saving $300/month at age 25 will have almost 10 times more than if they had waited until they were 45 to start saving $300/month! The 25-year-old will have over $1,000,000. The 45-year-old will only have under $180,000. This assumes an 8% rate of return.

The 45-year-old would need to put significantly more towards their investments each month to reach $1,000,000. This shows the power of investing early. You don’t need as much and it still compounds drastically over time.

#2 – Investing offers the best rate of returns

The example I used above is based on historical averages. The stock market averages a 6-10% rate of return over time. You can’t find those types of rates in any other savings account. In fact, it’s hard to find those kinds of rates anywhere. The chances of the rates being higher is on your side as well.

You have the ability to research different stock and fund trends. You can see over time how well they perform. This gives you an idea of what type of return you can expect in the future. Keep in mind that you can’t predict the stock market. You can just do your best to make decisions based on past performance.

#3 – The pandemic opened doors for buyers to get in at good rates

Thanks to the coronavirus, the stock market dropped. Buyers could buy stocks and funds for a lot cheaper than they were before the pandemic. This means the time to start investing is now! What goes down, must come up. The market already started turning around, but the time to buy is still looking good.

As long as you’re investing for the long haul (which is the best strategy anyways), you’ll be able to ride the waves of the market. What goes down must come up and what goes up must come down. You just have to stick it out and you’ll see that average of 6-10% return.

#4 – You can start for as little as $10/month

You don’t need large sums of money to get started with investing. Now, there are robo-advisors and online brokerage firms that will help you invest for as little as $10/month. One of my favorite investment platforms is Betterment. Betterment accepts recurring transfers of $10 and up to invest on your behalf.

Anyone can afford $10 a month to start investing. Why wait for the new year at that point?! There are other great platforms for investing as well – Robinhood, Acorns, Fidelity and Charles Schwab are all good options. Each platform functions a little differently, so do your research before committing. You can always try multiple platforms as well.

#5 – The best way to learn is to do

Don’t let a lack of knowledge stop you from investing. In fact, when it comes to investing, the best way to learn is to do. Just get going with investing and watch what happens. Watch as your investments go up and down. Read about why the market is going up and down. Before you know it, you’ll have a better understanding of what’s happening.

As I mentioned earlier, no one can predict the stock market. That means no one knows what it’s going to do. So, the excuse of not knowing how to invest doesn’t take you far. Nobody knows what will happen, but no risk, no reward. Get out there and experience the market to learn what it’s all about.

#6 – You can’t afford not to start investing

At the end of the day, the best reason to start investing next year (or anytime) is because you can’t afford not to. Your future depends on your investments in the present. If you want to own a home, secure your life in retirement, take care of your children, or simply build wealth, you need to start investing. Trust me, the longer you wait to start, the harder it will be to make the big, big bucks.

Related: Easy Ways to Start Investing

I hope I’ve convinced you to make investing a top priority next year (or even now )! With the accessibility being better than ever, and the cost of entry being so low, there’s no good reason not get started with investing. Have you been thinking about investing? What has stopped you from getting started? Post a comment below to share and get some feedback!

1 thought on “6 Reasons to Start Investing Next Year”

I’m getting more into individual stock investing. I’ve been using Robinhood and really enjoy it!