Interest is a funny thing. It seems complicated, and it can be, but a financially savvy lady needs to understand how interest works. This week’s Finance 101 topic is going to cover the basics of interest and how it can work in your favor.

There are some interest rates that can’t be controlled, and there are some that can. So ladies, put your knowledge caps on and get ready to understand interest!

Compounding Interest 101

Before we get into the aspects of paying and earning interest, understanding common interest terminology and concepts is a great starting point.

• Market Interest Rates: The market determines interest rates for investments, money market accounts, bonds, and bank accounts. “The market” refers to the specific industry field of the investment, or the economy as a whole.

• Inflation: Measured as an annual percentage, inflation is the gradual increase in the general level of prices for goods and services. The value of the dollar is based on its purchasing power.

As inflation rises, each dollar you have buys less of a good or service.

Investopedia explains this process perfectly: “When inflation goes up, there is a decline in the purchasing power of money. For example, if the inflation rate is 2% annually, then theoretically a $1 pack of gum will cost $1.02 in a year. After inflation, your dollar can’t buy the same goods it could beforehand.”

• Compounding Interest: Interest earned is generally termed as APY, which is the annual percentage rate. When an interest rate is quoted with APY, your money compounds. This means that you earn interest on your initial money, plus previous interest payments.

This also means that you pay interest on your initial loan, plus additional interest payments already added.

Paying Interest

Interest is the price you pay to borrow someone’s money. You pay interest when you are taking out a loan, purchasing items on credit, financing a car or house, or using any form of money lending.

On top of paying the original amount of the loan or credit (usually called principal), you will pay a little (or a lot) extra due to interest. The amount of interest you actually pay is based on your interest rate.

It is not uncommon for credit cards to have interest rates ranging from 10%-29%. In this case, your credit history usually determines the rate.

The interest rate on a house or car is calculated slightly differently. While your credit history does play a role, economic conditions in the market usually determine the lowest interest rate.

The interest rates for home loans usually range from 2.5%-10%. Auto loan interest rates typically range from 1.65%-10%. The length of the loan, as well as the willingness of the lender to make loans, can also determine the interest rate.

To ensure the lowest interest rate possible, as designated by the market, you have to have better than fair credit. The higher your credit score, the less risky you appear to the lender.

If your rate is established, then the length of your loan will determine how much interest you will pay. Always go for the lowest term that you can afford. The longer your loan term, the more you will pay in interest, period.

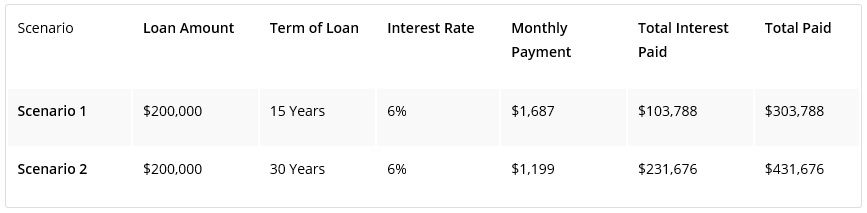

Look at the example below to see how interest can affect you. Let’s say you are purchasing a house. You are financing $200,000 at a 6% interest rate. For mortgages, you usually have 15-year and 30-year term options.

If you finance the home for 15 years at a 6% interest rate, you will pay a total of $303,788 for the house. If you finance the home for 30 years at a 6% interest rate, you pay a total of $431,676.

That means you are paying more in interest than for the actual house! So while the lower monthly payment seems appealing now, it is really costing you so much more.

Earning Interest

The same rules for paying interest apply to earning interest. When you put your money in a bank savings, checking, CD or other interest bearing account, you are essentially loaning money to the bank.

Banks use your money to make loans. So, to convince you to keep your money in the bank, they offer interest. The market and account type determines the level of interest you earn.

Credit unions offer better rates than common banking institutions like Chase and Wells Fargo, but online savings accounts like American Express Bank and Barclays offer the highest interest rates around.

For more on the account types that earn interest, check out Finance 101: Checking, Savings, and High Yield Interest accounts. Simply letting your money sit in a bank account means you can earn more than you started with.

And yes, interest in these accounts is compounded, so you make money off the original deposit and any interest already earned.

The concept is exactly the same for investments and retirement plans, on a much larger scale. When you invest in a retirement plan through your employer or a brokerage firm, the money you put in is invested in a combination of stocks, bonds, and funds.

The standard rate of return on long term retirement investing is 8%. Notice that we said long term. This means that you may not see 8% returns every month, but over time, and through the ups and downs of the market, you will see an average 8% return on your overall investment.

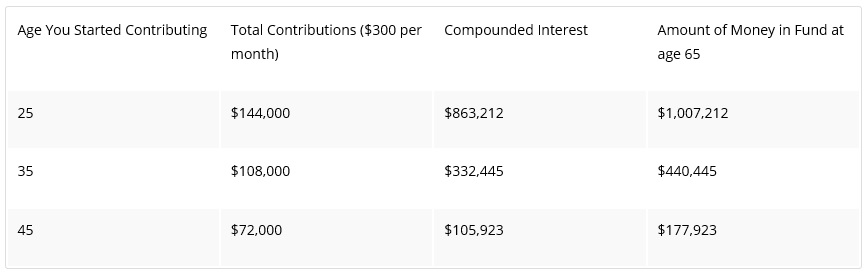

That 8% return is essentially your compounded interest rate. Look at the table below to see how compounding interest in a retirement plan works to your favor. We are using an interest rate of 8%.

Just look how longer terms in loans benefit the lender, longer terms in your retirement benefit you. Look at those numbers! If you start contributing $300 a month to your retirement plan at age 25, you will be a millionaire at age $65!

All thanks to the compounding interest! That alone should be your reason for contributing to a 401(k) or IRA!

Related: How Credit Scores Affect Interest Rates

As we mentioned earlier, interest is a funny thing. It can help you tremendously or hurt you tremendously. However, understanding how interest works is the first step in making sure that you don’t get fooled!

What did you think of the ways interest can help or hurt you? Are you inspired to start saving? Share your thoughts with the community by leaving a comment below!

2 thoughts on “Finance 101: Compounding Interest”

I am definitely inspired to make sure my retirement plan reflects these numbers. Saving at 25 could result to over $1 million in 40 years! That’s amazing!

I am definitely I priced as well. This has made me take savings more serious as well as caused me to reevaluate my contributions to my 401k