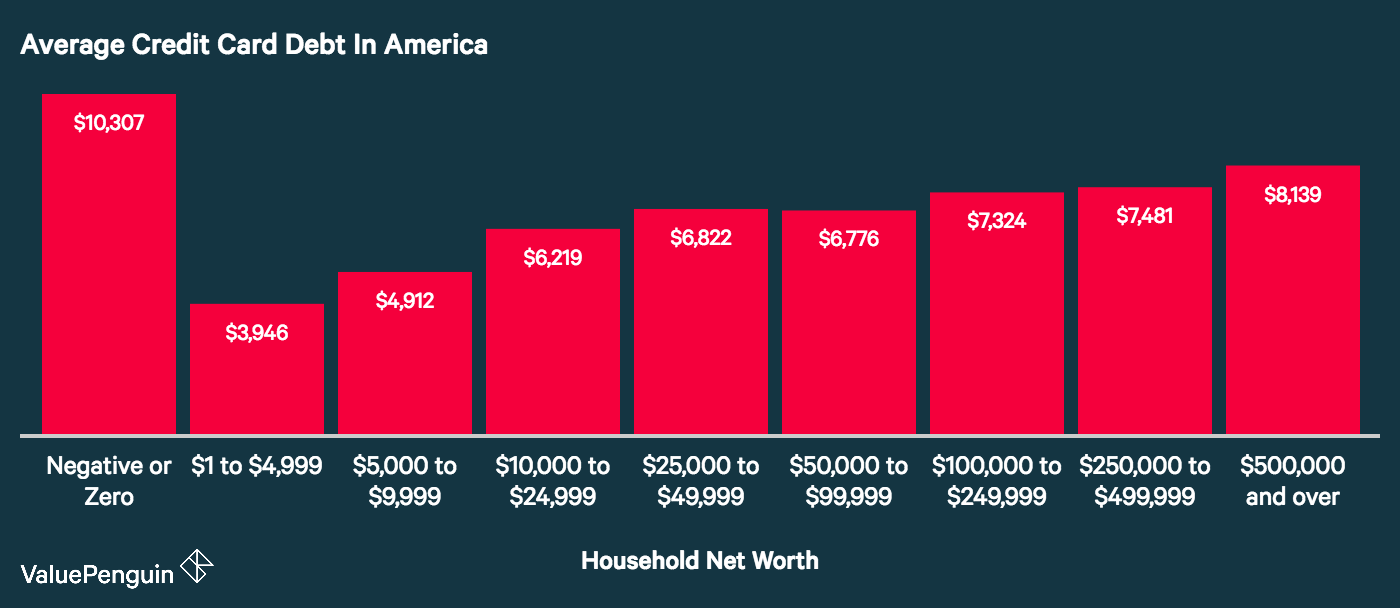

According to ValuePenguin, the average American household in 2016 has about $5,700 in debt. What’s even more startling is that households with $0 or negative net worth have about $10,307 in debt. This could mean that if you aren’t making enough money to cover your expenses, your family is resorting to credit card use and increasing your debt. DIY debt reduction is possible, regardless of net worth level!

Here’s a chart to show where each net worth bucket falls. This information was last updated in May 2016.

This chart also shows that the next highest debt falls to households whose net worth is over $500,000. The thought is that they can easily pay down their debt, but if they don’t have the right spending habits, it’s not going anywhere.

The CGS Team understands that debt is a serious problem among young women. That’s why we work with clients to help fix their spending habits and get themselves out of debt. However, if your spending is in check but your debt doesn’t seem to disappear, this guide is for you! The CGS Team is sharing a do-it-yourself guide to reducing your debt once and for all.

Step #1: Prepare Yourself Mentally

Some, if not most, people have gotten to a point where they simply don’t care to know what their debt is. They feel like it’s never going to be paid off, so why think about it. It’s easy to just give up and “deal with it later”, but that will not solve your problem right now. To really knock out your debt, you have to prepare yourself for the challenges ahead.

These challenges include actually looking at your debts (all of them), creating a plan that may take years to succeed, and cutting back your spending until your debts are paid off. The first step is to mentally prepare yourself! If you aren’t ready to deal with it, then you will not give the plan your full attention and ultimately will give up.

Step #2: Understand What You Owe

If you don’t really know how much you owe, and what it’s costing you, how can you pay it all back? The reason why preparing yourself mentally is the first step is because the second step is actually looking at what you owe. Looking at the interest rates, the interest you’re being charged thus far, your balances, and your due dates. Start by making a list of every debt you owe. Include student loans, credit cards, payday loans, 401k loans, mortgages, and any other debt form. Make a list of the following information for each debt:

1. The creditor’s name – Who do you make the payments to?

2. The total amount of debt you owe – What do you owe?

3. The available credit amount – What available credit do you have left?

4. The minimum payment required each month

5. The interest rate

6. The due date for your bill – Can this be changed if it falls within your rent pay period?

Once you have all of this information for each of your debts, you can assess your current expenses and work on a debt reduction plan.

Step #3: Create a Budget, then a Plan

Before you can create a debt reduction plan, you need to know what money you have left over after your expenses are paid each month. To see this information, you need a budget. A budget can be in written or electronic form. Most banks give you an idea of where your money goes each month, but you need to confirm those spending categories.

We recommend writing out your income, expenses, and excess spending in a weekly form (including monthly totals). Be honest with yourself, because any extra cash can be used to pay down your debt. If you need assistance with an honest and realistic budget, visit the Start Your Budget page.

Once you have your budget in place, you should see how much cash you have left over each month after your bills, expenses, and fun-spending are accounted for. This number should be added onto your debt payments. If this number is negative, you need to cut back in some areas to get yourself into the positive each month.

Deciding how to apply that extra payment is the tricky part. The snowball method is one of the most effective, and it’s the method used by CGS Founder Raya when assisting clients. First, decide if you want to tackle debts with the highest interest rate or the lowest balance. Debts with the highest interest rates are costing you more money, however if you need small victories throughout the debt payment process, focus on smaller balance debts first.

Once you have your method in place (interest order or balance order), apply your extra income onto the payment of the first debt. Once that debt is paid off, use that extra payment and that debt’s minimum payment to add onto the next debt’s payment. Continue to do this until all of your debts are paid off. If you are writing this plan out, to see when your debts will be paid off, don’t forget the interest that is accruing.

Step #4: Revisit Your Plan Monthly

Once your plan is in place and being implemented each month, refer back to it on a monthly basis (at minimum). Do you need to adjust your budget and spending? Did you make more income? Did a new expense pop up? These questions need to be addressed so that you can update your debt reduction plan as needed. If nothing has changed, keep checking your progress. Update your debt balances to see them going down each month. It will give you some motivation!

Step #5: Keep Pushing Through

Depending on how much debt you actually have, the debt reduction process could take a long time. It’s important to stay disciplined and strict with yourself while paying down your debts. Do not let yourself fall into a spending trap because you will feel so much worse knowing that your hard work up until then just went down the drain. It’s so easy to spend thousands of dollars, but it is so difficult to recoup that once it’s gone. Don’t give up! The CGS Team is here for you.

Related: 7 Tips for Paying Down Debt

Getting out of debt is not an impossible task! Follow the steps above and stay focused. Do you have crazy amounts of debt, thanks to spending or student loans? What is your current method of paying that debt off? We want to know what works for you! Post a comment below to share!

2 thoughts on “DIY Debt Reduction”

Such an informative article! It’s pretty crazy to see the debt for each household’s income category.

Happy Monday Ladies! @lindseypavlov @tiffreone @ndupree @nathaly07 @ascott10591 @caitlinemoore @brianna-barnes @chaunte @sicox Have you seen the new post “DIY Debt Reduction Plan”? We’re sharing how to tackle your debt head on!