The CGS Team is excited to introduce a new column in the City Girl Savings community! Daniella’s Finance Journey outlines the financial experiences that CGS member @daniellacoin is going through as she works with the CGS Financial Consultant to get on financial track. Daniella has graciously offered to share her journey to help inspire and motivate others to take control of their financial lives!

Daniella’s Share:

“I’m frustrated because I sat in the rain for a half hour waiting for a bus because I knew that spending money on Uber would put me further from my goals. I’m not feeling like I’m making progress. I feel like I should be better than this.”

This was almost verbatim what I said to my CGS Consultant on the phone during our weekly call. I was so irritated because not having control of your money is upsetting. When you have vision for your life and your reality does not match up, the hardest thing is trying to close that gap. I am living on my own for the first time in my life. I am taking this time to really focus on my goals and development. Whether it is finding a fitness routine that makes me feel normal, or finding a budgeting system that does not stress me out or even finding a cleaning routine that has my apartment seamlessly organized.

Change is a difficult process because it requires a lot from you. The discomfort of going against your familiar habits can be so strenuous, restricting, and annoying, but it really does lead to a difference in how your life runs. I think my CGS Consultant and I really turned a corner this week and I want to give tips on how to get the most out of your consulting, when and if you decide to go through it:

1) Be meticulous. I was not thorough when filling out my budget form in the beginning and it cost me. Now, some of the things I needed I didn’t have because I just moved so that got settled after the fact. However, it is a great habit to know what is coming out of your account. Just like fitness boils down to calories in verses calories out, basic finance is money in verses money out. What days do you get paid? What days are your bills due? What days are your leisure expenses due? (This is what I failed at. I had about $40+ dollars that I would lose a month with no idea when it would be taken between Netflix, Hulu, Apple Music, etc.) Just seeing how much you spend will really help you get a hold of yourself.

2) Be honest. I was embarrassed to tell my consultant what was happening in the beginning. I was falling behind and not telling her what was happening, and she noticed because the numbers didn’t add up. Now I tell her about the shopping trip or the extra food and that really helps me to feel more grounded. When I told my consultant how I felt this week, we readjusted my budget so I can feel in control. It really helps me when I give my consultant all the information because now she has all the tools to help me.

3) Trust yourself. You are on this site for a reason, and that alone means you want to do better. I’m nowhere near perfect but I am so much closer to my goals with a plan then I was when all I had on the situation was awareness. Through the conversations, I realized I have a general over-consumption issue when I’m sad, which resulted in overspending or overeating. Now I’m focusing on ways to make myself feel better and that is a fun, creative journey. This blog is one of the results of that realization. So allowing yourself to make better decisions all will push you closer to your goals.

This week I think we turned a corner and I’m looking forward to my next paycheck and staying on track. CGS Community we are going to get through this, I promise.

Are any of you seeing any progress on a goal you set? If not, do you have a plan? Comment below! I want to hear from you!

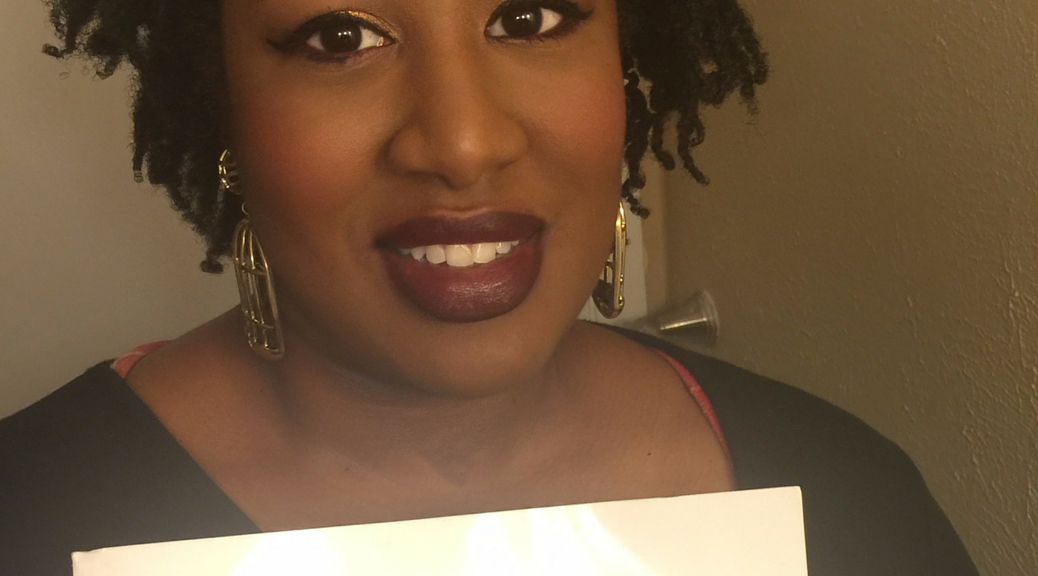

Daniella

About Daniella…

Daniella is a 25 year old working millennial living in Dallas, TX. Daniella is originally from New York and has moved to Dallas to start a life of adulthood on her own. She currently works as an administrative assistant and has a passion for make-up! Feel free to leave a comment with any thoughts or questions for Daniella.

1 thought on “Daniella’s Finance Journey: Week 3”

Need a mid-day break? @mgately @ashlekt @KaraMcDono @AshNicLong @lauraann @ashtonrider @kelly-lutz @laurenfried @ccondiff @elizabeth-truemper Check out “Daniella’s Finance Journey”! Our client Daniella is sharing the ups and downs on the road to financial success with the help of the CGS Team! She keeps it very honest!