Daniella’s Finance Journey outlines the financial experiences that CGS member @daniellacoin is going through as she works with the CGS Financial Consultant to get on financial track. Daniella has graciously offered to share her journey to help inspire and motivate others to take control of their financial lives!

Daniella’s Share:

Hey CGS Community!

Since October is a month often dedicated to the horror enthusiasts I’m going to tell you a scary story. There was once a girl that liked nice things. She would buy it and figure out things like food and transportation later. Usually at the behest of her parents. Then one day, she got her own apartment and started having to pay rent! BUT… it gets worse… First it was an internet cancellation fee. Then, it was the first, last, and security rent for her apartment. Then it was furniture. All of her money had to go to things that weren’t found at the Kate Spade store! How was she to survive? She got a budget counselor. And then her worst nightmare came true… there was a site wide SPENDING FAST! (Cue lightning and thunder.)

Although I was being facetious, this truly is a horror story for me, being on a spending fast. The thing about my spending isn’t that I make ridiculous choices. My apartment is reasonably priced for my income, my bills can theoretically be covered with one paycheck, and I truly don’t shop as much as you all would think. My problem is the actual thousands of dollars I have lost to food this year. Buying groceries I never cooked, eating out all the time, and most detrimental—the less that five dollar purchases made over the course of a week that amounts to me having spent $200 over budget ALL. THE. TIME.

I’m afraid of the spending fast and it is not because I can’t shop. I have enough foresight to know a need and a want. It is because I have to control my urges. Starbucks, breakfast sandwiches, my doubleshot espresso cans, candy and snacks from the vending machine, all of those things can easily cost me $50 for the week. In addition to the actual meals. Here is how I’m trying to keep myself from failing:

1. I am leaving my bank card home, I carry it religiously, broke or not I always have my card. This time I am getting into the habit of leaving it home. Raya has been trying to get me to do this for ages, to no avail, but this time it is necessary. However, twice without realizing it I was at a register getting ready to buy something and had to put it all back because I left my card at home. It has been THREE DAYS.

2. I am deleting all of my spending apps. I have apps for Sephora, Macy’s, ULTA, UberEats, Favor, Dominos, Postmates, Starbucks… All of that is temptation. You get notifications about deals, you get perks that you have to uses within the next few days or its gone. Now seeing that with no money is different to seeing that with money. I deleted those apps so that I can focus on fighting my tangible temptations, and not overwhelm myself with digital temptations as well.

3. I told my friends realistically what I’m doing. I let them know that I am doing a spending fast, and that I went from 5 credit cards down to two. So this is important to me and if it AINT FREE I AINT GOIN. The response has been mixed. Most don’t get or are confused but supportive because they are normal and don’t have the issues that I do with money. Some of my friends are broke so they are like ‘YAAASS we can find something to do! Its going to be a fun challenge.” And one friend said that we will go out but it will be on her because I am always really generous when we go out, so she is relishing the opportunity to return the favor. I feel good for being honest and while it is uncomfortable it is much needed.

4. I am remembering the goal. All I want is to be debt free by the end of the year. I want to get my paycheck and it be my money and not flying right back out of my hands for unnecessary bills. It is going to be a tough sacrifice for the next month and a half. I am missing out on the State Fair, I am missing out on Halloween with friends, and I won’t lie that I bums me out a little. However, the more I think about it, I’m less afraid of what I can’t do right now and more excited for what I can do in the future.

Comment Below! Are you on the spending fast? How is it going?

xoxo

Daniella

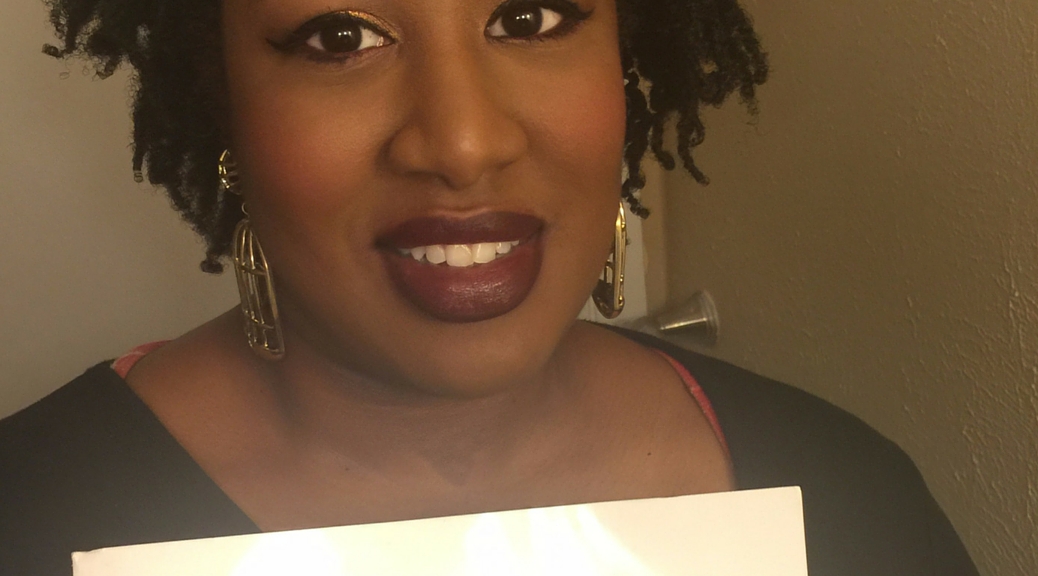

About Daniella…

Daniella is a 25 year old working millennial living in Dallas, TX. Daniella is originally from New York and has moved to Dallas to start a life of adulthood on her own. She currently works as an administrative assistant and has a passion for make-up! Feel free to leave a comment with any thoughts or questions for Daniella.