Daniella’s Finance Journey outlines the financial experiences that CGS member @daniellacoin is going through as she works with the CGS Financial Consultant to get on financial track. Daniella has graciously offered to share her journey to help inspire and motivate others to take control of their financial lives!

Daniella’s Share:

When you are trying to get your finances in order it is so overwhelming to pick what to focus on. I had a lot of goals this year. I wanted to learn how to control my spending, be debt free and build a savings. Those were three major things that should go hand in hand but it didn’t. While I feel like I learned about proper spending and being better with a budget, there were things I struggled with. I paid off 3 out of my 6 cards. I am going to pay off my 4th debt later this week. And I will be down to the final two. Now, I originally wanted to pay off my cards by the end of the year, but that is not going to happen. It could, but I run the risk of going right back into debt to do that. One of my mistakes that I made this year was that I wanted to pay things off in huge chunks. When I put two or three hundred dollars on a card and was broke and using the same card to get by until payday, I never really made any progress.

I am thinking deeply about my “CGS Success Story” and whether or not I deserved that title. I mean, I didn’t really build a savings or finish all my debts, so that means I failed, right? WRONG. I am a success story because I was able to update my budget on my own and look at where I could cut back and make decisions for myself.

One of my less tangible goals was to be able to manage my own income. I want to have my own business and I know that there is no way I could effectively have a second income if I couldn’t maintain my first. Now I know how much money I actually make, and what my responsibilities are. That may sound intuitive to you, but it was one of the most frustrating areas in my life to be honest.

Now that I am nearing to a close on my time with CGS, I am preparing for my new updated budget. I spent my Saturday forecasting responsibilities and planning out my savings plan for next year. See, I realized that I wasn’t following my own advice. I can make massive payments, and still save. I just didn’t have enough money to do that. So I decided for me to truly win, I needed to prioritize. Here is how I broke it down:

1. I am refocusing my energy on distributing my bills so that I have more flexibility on payday. I get paid twice a month and on one of those checks I am paying almost ALL of my bills. I am left with $70 before I have even gotten that check. I moved a lot of the bills, cancelled Netflix and Hulu so I can resubscribe when I want them to charge me. This will help me to not be strained until my next paycheck.

2. I am going to make a reasonable payment plan that will take about 6 months instead of trying to pay things off in two. (Which is exactly what I have been failing to do.)

3. Next year with my remaining debt a lower priority, I am making it my goal to save 6 months of expenses. I would need to save need to save $6,000. Now given my actual amount to save per month, I think that may be a lofty goal. It may not get completed in one year but it is my goal. Halfway there will still be better than broke.

If you are struggling to prioritize what to do if you have a laundry list of financial goals, then follow these three steps that helped me categorize my next steps:

1. Evaluate your income and see how you can optimize it. Can you move bills around? Do you need all of your subscription services? (I went to cancel one and got a free month!) This is a great reason to get a budget consultation and have the CGS Counselor help you budget for happy hour.

2. Pick what you want to fix first. This is the one that stresses you out the most. Initially I was stressed about the debt I had gotten myself into. Now I am more concerned about not having enough money in savings. Just pick one and focus on it.

3. Make a REALISTIC plan. You didn’t get into this mess overnight, so you can’t fix it that quick. There is no point in doing all of this work if you don’t actually make any progress.

Hope this helps!

Comment below: What are your financial goals for next year? Have you started thinking about them?

xoxo

Daniella

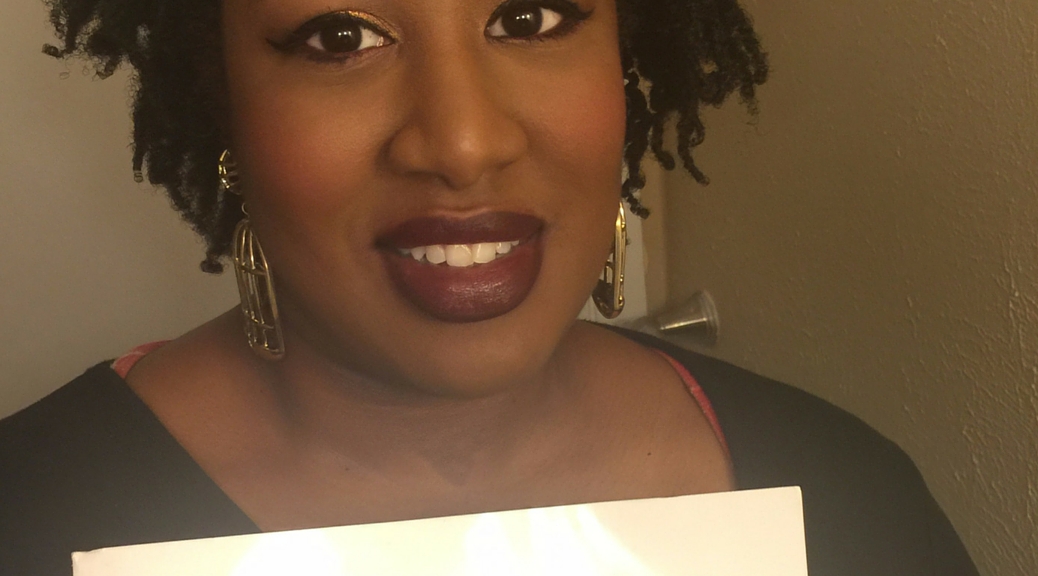

About Daniella…

Daniella is a 25 year old working millennial living in Dallas, TX. Daniella is originally from New York and has moved to Dallas to start a life of adulthood on her own. She currently works as an administrative assistant and has a passion for make-up! Feel free to leave a comment with any thoughts or questions for Daniella.