Daniella’s Finance Journey outlines the financial experiences that CGS member @daniellacoin is going through as she works with the CGS Financial Consultant to get on financial track. Daniella has graciously offered to share her journey to help inspire and motivate others to take control of their financial lives!

Daniella’s Share:

Hey CGS Community! I’m back after a little hiatus. August was a busy month with work and travel and a lot has happened. So after a work trip and a weeklong visit home, it’s time to buckle down and gear up for the holidays.

My work trip was paid back to me from my company, so that budget wasn’t really relevant. My trip home, however, was a challenge to keep it under $300. Now, if you’re wondering if I did given my consistent history of going over budget for things. I was on budget! What did I did to make myself successful this time?

1) I planned out my week in advance. I literally counted out how many days I was going to be home and what activities would happen on each day. I was able to say $300 is realistic for 5 days.

2) I ACTUALLY used cash. I took out $240 in cash and kept the remainder on my card for ubers and travel. Rolling on cash really helped me to see the value of a dollar. I frequently go over budget on very small purchases ($3-$10) so seeing a $20 bill dwindle quickly really slowed me down and made me think about my purchases. I also left my bank card home when it was reasonable. When I was going to the mall with my parents I took $60 and left my bank card. When I was traveling in Manhattan I kept my card with me because I was too far from home to possibly be stranded. However, I will note that I avoided my favorite stores because I needed to keep my budget.

3) I was straight forward about what I was doing with the people I was with. I would literally tell my friends “Hey I’m on a budget, so this is what I can do.” For instance, my friends wanted to go out and also have brunch the next day. I told them I can go out that night or have brunch, but I can’t do both. It isn’t fun saying no to things, but I can totally see that as a necessary step to achieving my goals. I had way more pride in myself because I did what I set out to do, rather than doing what everyone wanted me to do.

All in all, I have shown myself that I am capable of keeping a budget. So this week I am experimenting with some changes and I will report back on my next post in two weeks. I’m trying to see what I can do to make my budget more realistic.

Comment below CGS Community: What are you struggling with in your financial goals. What is holding you back?

Regards,

Daniella

About Daniella…

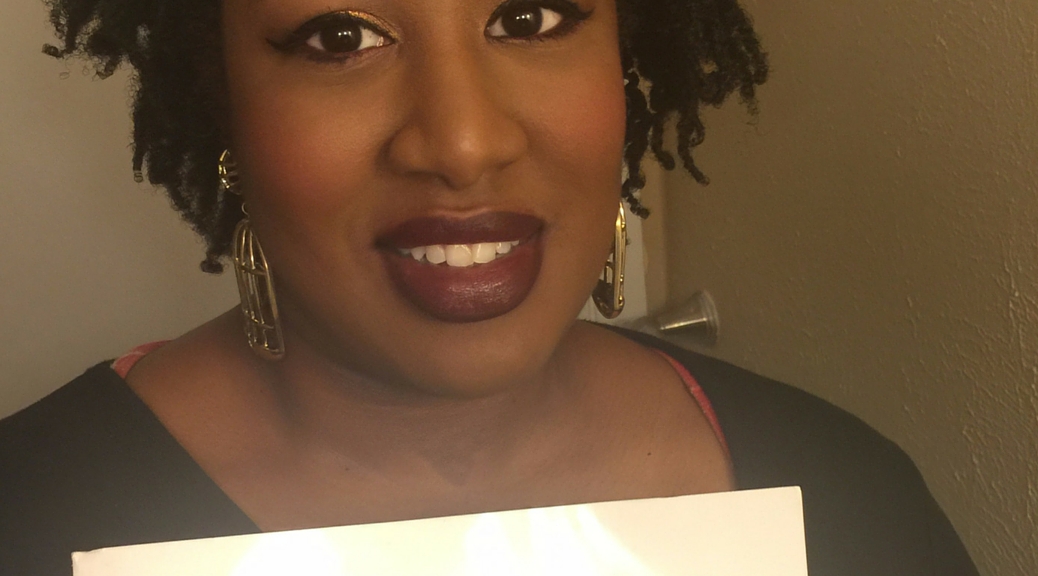

Daniella is a 25 year old working millennial living in Dallas, TX. Daniella is originally from New York and has moved to Dallas to start a life of adulthood on her own. She currently works as an administrative assistant and has a passion for make-up! Feel free to leave a comment with any thoughts or questions for Daniella.

1 thought on “Daniella’s Finance Journey: Pay Check 2”

This is great! It’s so hard to tell admit to friends that you can’t afford everything that they want to do. I’ve found that when I put my foot down they generally agree that saving money is a good idea, so we end up doing something cheaper (or free!)