According to Northwestern Mutual’s 2018 Planning & Progress study, 21% of Americans have nothing saved for retirement, and about 33% only have $5000 saved. This basically means that 31% of U.S. adults would not have enough money to retire. Do you want to be in that boat? Imagine wanting to retire but because you failed to save, you have no choice but to keep working. Wouldn’t you rather be on track to retire timely?

The good thing about saving for retirement is that the younger you are when you start, the less you have to save with. Ultimately, what gets you the best return is time. The longer your money has to grow and earn money on top of itself, the more money you will have when you are ready to retire. So, how do you know if you are on track?

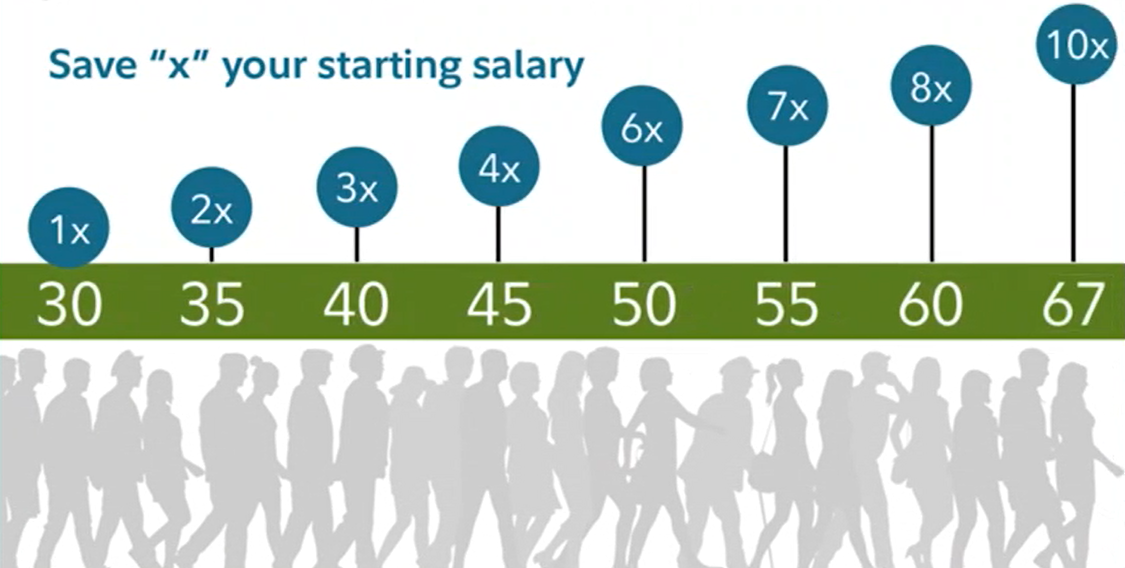

Target retirement savings

The chart above shows what you should have saved at every age of your career, starting with 30. By the time you are 30 years old, you will want to have the equivalent of one year’s worth of salary. Keep in mind, the salary amount is determined by the amount of money you were making when you actually started saving for retirement.

For example, if you entered the workforce at 21 with an annual salary of $35,000, but you didn’t start saving for retirement until 25 when you had an annual salary of $40,000, then you would want to have $40,000 saved by 30. This is a good guide to follow to determine if you have enough money saved for retirement.

One thing to keep in mind is that these numbers could vary by person. If someone plans on having multiple properties, will run a business, or may have extensive debt throughout their life, then they may want to have more saved for retirement. If you plan on having your house paid off before retirement, and don’t need much to live on, then the chart above is a great path to follow.

Late starters

If you are coming to the retirement saving party late, don’t panic. It may not be feasible for you to save one year’s worth of salary by age 30, especially if you’re making big bucks. Try to save as much as you can afford to. A few ideas:

- Contribute up to the annual cap for 401k ($18,500), set by the IRS

- If you reach the 401k cap, save an additional $5000 in an IRA (also the cap)

- If you can’t reach either cap amount, contribute what your employer will match, at minimum.

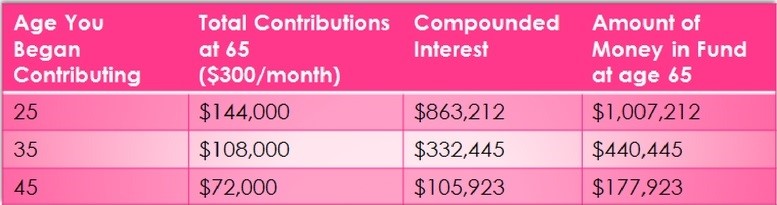

I’m not going to tell you that starting late means you can save more and that will make up the difference, because that’s not the case. When it comes to retirement savings, the more time you have to save significantly beats the amount of which you plan to save. Once again, this is thanks to compounding growth. Check out the chart below, from the 8 Ways to Set Yourself Up for Financial Success article:

You can clearly see that saving in your 20s results in a much larger retirement nest egg, come age 67. If you are not saving for retirement, start right now. Don’t procrastinate because the longer you wait to start saving, the less you will have to use during your retirement. Trust me, relying on Social Security and Medicare is not a sure bet.

Related: How Much Should I Save for Retirement

I don’t want this article to scare you or make you feel bad for where you are with your retirement savings, but I do want it to motivate you to start saving more. You have the target savings amounts by each age above, print it out and reference it. Use it as your reminder to save as much as you can. Based on the chart above, are you on track to retire? How much are you currently putting into a retirement savings? Leave a comment below to share.