Originally coined by Elizabeth Warren and Amelia Warren Tyagi in their book “All Your Worth: The Ultimate Lifetime Money Plan”, the 50-30-20 budget rule has become a savings strategy used by general savers, budgeting companies, and financial experts everywhere. It’s actually a great budgeting method to leverage, especially if you’re new to budgeting!

Have you asked yourself: what is the 50-30-20 budget rule?! You’re not alone! Today, the CGS Team is going to provide you with an overview of the 50-30-20 rule and how you can start implementing the strategy into how you spend your money. The 50-30-20 rule aligns percentages to specific expenses. Your expenses should not exceed the percentage of your income designated by the rule.

What is the 50-30-20 budget rule?

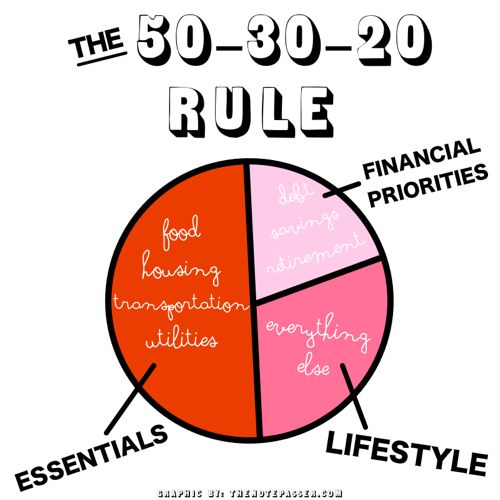

This image provides a great breakdown of the 50-30-20 budget rule!

50: Living Essentials

50% (or less) of your take home pay should be reserved for fixed living expenses. Rent, utilities, car payments, food – basically any fixed monthly expense that you need to survive. Sorry, cell phones are not an absolute necessity, so they fall into the Lifestyle category. This category also includes minimum debt payments.

Typically this category takes up most of your income. Try cutting back on how much you spend at the grocery store, or look for a place with a cheaper rent. Reducing your expenses in this category will make it easier to stay within your means in the other categories.

30: Lifestyle

30% of your take home pay can be set aside for flexible spending. Entertainment, dining out, cell phone, travel, gas, hobbies and more fall into this category. If you are not conscious of how you spend your money, it’s very easy for “lifestyle” spending to add up. Since your living essentials and savings are more important than the fun stuff, do your best to take care of the Living Essentials and Savings categories before going all out in the Lifestyle category.

20: Savings and Debt Repayment

20% of your take home pay should be allocated to your savings, credit card debts, and retirement. Depending on how much debt you have, the full 20% (or more) may be allocated to your debts and not your other savings. Strive to save for retirement regardless of your percentage situation.

Most retirement savings is taken out of your paycheck automatically, which allows your take home pay to go towards debt and savings. If you have not started saving for retirement, read over the 5 Tricks to Get Caught Up with Your Retirement Savings article and start ASAP!

A 50-30-20 Budget Rule Example

To help you get an idea of how the 50-30-20 budget rule should be implemented, we have provided a pseudo-income situation courtesy of LearnVest:

Molly is a 22-year-old recent graduate with her first job, working in Chicago. She has student loans, but she is still able to meet her student loan payment every month and contribute to a Roth IRA, plus pay all her bills.

Her income: $36,000 a year

Her take-home pay after taxes: $2,250 a month (we’re assuming 25% of her salary goes toward a combination of taxes and her 401(k) contributions)

Fixed Costs: Rent: $775 Transportation: $115 Utilities (including phone and internet): $135 Gym and subscriptions: $75 Total: $1,100, which is about 49% of her take-home pay

Financial Goals: Student Loan: $150 Roth IRA contributions: $200 Emergency fund: $75 Backpacking trip fund: $50 Total: $475, which is about 21% of her take-home pay

Flexible Spending: $675, which is 30% of her take-home pay

Related: 4 Budgeting Methods to Try

People often find it hard to reserve a specific percentage of their income to expenses due to debt, costs of living and other financial holds. If you can’t seem to get your expenses to align accordingly, consider a CGS Personalized Budget Plan and let CGS Founder Raya analyze your income and expenses to help get you where you need to be.

Do you currently implement the 50-30-20 budget rule? What about money saving tips? We would love to hear your feedback and experience! Share with the group by leaving a comment below!

3 thoughts on “What is the 50-30-20 Budget Rule?”

The perfect strategy for those who don’t want to think too hard about budgeting!

Wow, I never really thought about budgeting this way until I read this article! I don’t track how I am spending my money. I believe that getting a CGS budget will help my tracking of money and implementing the 50-30-20 budget rule!

I think this is my favorite article so far. It’s a pretty good breakdown of priorities and balancing out finances.