I just love this time of year! My Christmas tree is out and lit up. My peppermint mochas are on deck. I have Holiday in Handcuffs on repeat, and I’ve laid out my goals and resolutions for the new year. By now, you know I preach the importance of setting your new year goals a few months in advance, and for good reason. The more time you have before the new year starts to think about your goals, the better off you’ll be once the new year starts.

If you haven’t thought about your resolutions for the new year, there’s still time! I’m sharing 5 money resolutions to make right now and vow to work on them right when the new year begins.

Goals and resolutions should be set anytime of the year, but there’s nothing like the fresh start of a new year to get you going! Keep reading to learn the 5 money resolutions to make right now to improve your financial situation instantly.

5 Money Resolutions to Make Right Now

Money Resolution #1: “I will stop avoiding my monthly numbers”

In at least 50% of my consultations, whoever I’m talking to tells me that they don’t budget because they are afraid of what they’ll see. They are basically avoiding looking that their numbers, because they know it means facing the music.

Guess what? We’ve gotta face the music!

Avoiding your situation is not going to fix your situation. Instead of being afraid to check your bank account, being afraid to write out your monthly bills and expenses, and being afraid of understanding where your money goes, vow to embrace it!

Make the resolution to stop avoiding your financial situation, and start being open and honest about what’s really going on. You can’t fix what you don’t know is broken, and avoiding acknowledging what’s broken will only prolong your success.

Money Resolution #2: “I will create a plan to get out of debt”

Because debt is so easily used, so easily accumulated, and so easily accessible, it’s hard for people who have debt to imagine a life without it. It’s very sad when you think about it, because that’s exactly what the system is designed to do.

The system is designed to make accessing credit so easy, but then make it so expensive to have, and not care about if a person can truly afford to pay for using that credit. Granted, we are all adults and we make our own decisions, but if you weren’t taught how to use credit, it can look really good.

Because you weren’t taught how to use credit, and because the system is set up to make credit so easy to access, you can’t fully blame yourself if you’re in debt. However, you can blame yourself if you don’t have a plan to get out of debt.

Moving into the new year, make the money resolution to create a plan to get out of debt. Notice, I didn’t say “make the money resolution to get out of debt”. Let’s just start with the plan! A plan can make you feel 1000x better, and it can give you hope when you don’t have any.

There are a variety of different debt repayment strategies to follow. Find the one that will work best for your situation, and map out your plan of attack for becoming debt free.

Money Resolution #3: “I will increase my retirement plan contribution amount”

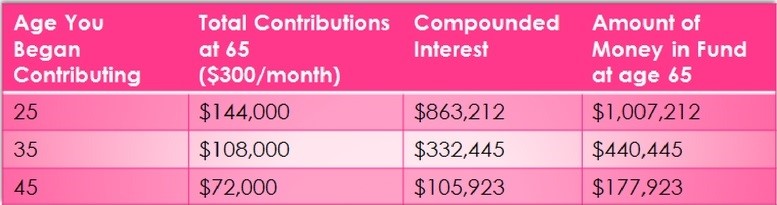

I’m bringing back my favorite chart to prove why it is so important to save for retirement as early as possible. In the chart below, you’ll see that a person who starts saving $300/month for retirement at age 25 will have over $1,000,000 by age 65.

You’ll also see that if a person waits to start saving $300/month until they are 35 or even 45, they will have a lot less money in their retirement account come age 65. This alone shows how important it is to save early and let it compound on top of itself.

The longer your money has to build on top of itself, the more you will have come retirement. A great money resolution to set for the new year is to increase your retirement plan contribution amount. Increase by as little as 1%. If you have an IRA, increase it by as little as $50/month.

Just the act of increasing your contribution amount, especially if you’re young, will help set you up for a more financially secure retirement. Also, check out Are You On Track to Retire for guidance on how much you should have saved thus far.

Money Resolution #4: “I will start reading and learning more about personal finance”

“Knowledge is power” isn’t a famous quote for nothing! There truly is value (and power) in learning more. When you learn more, you know more and you can do more. Your mind is open to new solutions to current problems. This is true in any area of life, especially finance.

The great thing about knowledge is that it can be obtained anywhere and in many different ways. However you prefer to learn, there is personal finance knowledge out there that can cater to you. A great money resolution to set is to start reading and learning more about personal finance.

Whether you listen to a podcast, listen to an audio book, watch YouTube videos, take an online training course, read a physical book, or work with a coach, make this new year the year you increase your knowledge of money and finance.

I promise you won’t be disappointed!

You can check out some of the personal finance books that changed the game for me, and you can check out my YouTube channel for videos to help you learn!

Money Resolution #5: “I will be mindful of my thoughts around my money situation”

The final money resolution to make right now is to be mindful of how you currently think about your money. Here’s the thing. When you constantly whine, complain, or think negatively, more and more negative things seem to happen.

On the contrary, when you practice gratitude, think positively, and focus on solutions (instead of problems), things tend to work out better for you.

Mindset is such a critical piece of the financial success puzzle, and the life puzzle for that matter. With that being said, try taking a positive approach when it comes to how you think about your financial situation. You won’t always think positively, but becoming mindful of how you do think will help you focus on the good more than the bad.

Next Steps to Take

Now that you have a few money resolution ideas to start with, you may be wondering what to do next. I’m going to share the very first next steps to take for each of the money resolutions listed above.

Money Resolution #1 Next Step

The first step to take to implement your money resolution to stop avoiding your numbers is to look at your numbers! Duh!

Block off at least one hour on your calendar and do a review of as many past bank account and credit card statements as you can get through. I’d challenge you to review at least 2 months’ worth of each. This exercise will bring to you face to face with your money and how it’s been spent over the past few months.

Money Resolution #2 Next Step

Moving on to the second money resolution of creating a plan to get out of debt. The first step to take for this money resolution would be to research all of the available debt repayment options and strategies there are available. Check out the City Girl Savings Debt articles to get you started. Once you know the debt repayment options, you can find one that works for you.

Money Resolution #3 Next Step

Here’s another easy one. If you plan to increase your retirement plan contributions, you can do so by changing your contribution percentage through your company’s retirement plan provider. If you don’t know who that is, contact HR to find out.

If you don’t have a 401k plan through your employer, then you can increase your IRA contribution through the company that is managing it for you. Lastly, if you don’t have an IRA or a 401k plan, the next step would be to open one and start contributing.

Money Resolution #4 Next Step

To move forward with the money resolution of reading and learning more about personal finance, start by thinking about how you like to learn and retain information. From there, find personal finance content on that particular platform (books, videos, audio) and start digging in!

Money Resolution #5 Next Step

The final money resolution may be the hardest of them all because it requires you to be conscious of your own thinking. If you’ve never practiced this before, I’d recommend you read Practicing the Power of Now. You can also try to write down thoughts that come in your head and analyze them to see if they are good or bad.

Need some assistance with sticking with your money resolutions?

Request a call with me and let’s get a good game plan set up for you!

Related: The Best Way to Set Your Money Goals for the New Year

This next year is going to be a powerful one for you, I just know it! How could it not be if you stick to any of the money resolutions listed above! Thinking about where you want to be next year, what money resolutions do you plan to set and stick to? Drop a comment below to share!

1 thought on “5 Money Resolutions to Make Right Now”

If you’re not sure where to start with your money and financial goals, this list is a great guide! Knock these things out, then focus on what you want!