Regardless of your current situation, you can set yourself up for financial success. There are things you can do to actually take control of your finances. People think they need to make a lot of money to be financially successful, and that’s so far from the truth it’s scary. The thing is, it’s not about how much money you make, but what you actually do with the money you do have.

Here’s a great example:

Jillian makes $115,000 annually for salary at her job as a project manager. Jillian lives in New York and rents an apartment for $2500 a month. That’s probably low for NYC! Anyways, Jillian has $12,000 in credit card debt, has no savings, and is paying her student loans down. While Jillian brings in about $6,500 a month after taxes.

After rent and living expenses, Jillian has about $3500 to live on. Jillian loves going out to eat, shopping, and traveling. She’s paying the minimum on her credit cards (about $200) and after everything is said and done, she carries over a couple hundred dollars to her next paycheck. With no budget and no plan for her credit card debt, Jillian is not opening the door for financial success.

On the other hand, Melissa makes $48,000 annually for salary as an executive assistant. Melissa lives in Austin and rents and apartment for $1100 a month. Melissa also has $12,000 in credit card debt, saves $100/month that is never touched, and is paying down her student loans. Melissa brings in about $2,800 a month after taxes.

After savings, rent and living expenses, Melissa has about $1150 left over. Melissa has a budget that shows she can afford to dine out and shop for $300 a month. Melissa pays $350 a month for student loans, and puts $400 towards her credit cards. This leaves her with $100 left until the next pay period.

Because Melissa is limiting her discretionary spending and contributing significantly more than the minimum on her credit cards, she will be credit-card debt free way before Jillian. She will also pay less interest. Melissa is also saving $100 a month. As long as she doesn’t touch it, it will continue to grow and serve as an emergency fund.

The moral of the story is that you don’t need to make a ton of money to achieve financial success, you simply need to make the right money moves for your situation.

Today, I’m sharing 8 ways to set yourself up for financial success regardless of your current financial standing.

#1 The number one tool for financial success is a budget.

Referring to the example above, Jillian has money to enjoy the things she wants. However, since she doesn’t have a budget, she likely doesn’t realize how much money is going towards the discretionary items. She knows her money is going somewhere, but where? If Jillian had a budget, she would know exactly what she could afford to spend on fun stuff and still get other responsibilities taken care.

A budget does not mean you can’t enjoy life. A budget simply means you are fully aware of what money is coming in and what money is going out. Your budget will show you what you can afford to spend on yourself, and how you can reach your financial goals. It doesn’t matter how much or how little someone earns, a budget is needed in every financial situation.

If you don’t know where to start when it comes to creating a budget, consider a personalized budget and spending plan from City Girl Savings. If you want to do it on your own, start with the basics. Get your income and recurring expenses on paper. What’s left over? Allocate that left over amount to your financial goals.

#2 Contribute to a 401k plan.

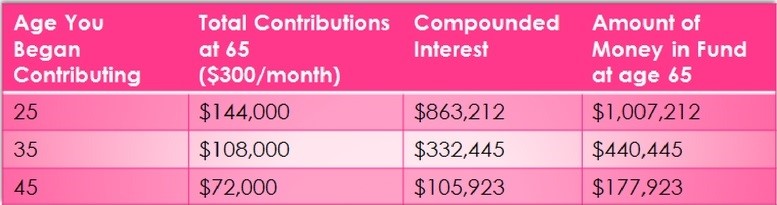

I don’t care how much you make, you absolutely need to save for retirement. People don’t realize that the longer they wait to start saving for retirement, the less money they will have – even if they save extremely large amounts. The reason is because compounding interest works better with time. The more time your money has to make money on top of itself, the more money you will have come retirement time. If you don’t believe me, look at this chart:

The person who starts saving $300/month at age 25 will have almost 10 times more than if they had waited until they were 45 to start saving $300/month! These numbers are based on the historical growth rate. If you knew this was true, why would you wait to start saving for retirement. Most companies offer matching contributions, so that $300 may be significantly less coming out of your pocket because your employer is helping!

#3 Pay yourself first.

This concept may seem difficult to understand, but it will change your life! Let’s go back to the example above. Jillian couldn’t find room in her finances to save money. Melissa automatically saves $100/month before she even considers her other expenses. Since Melissa made the decision to pay herself first and put away $50/check directly into savings, there’s nothing more she needs to do.

Apply this concept to your situation. Find that number that you can part with without hindering your other obligations. Whether it’s $50/month or $500/month, make it a point to have that amount directly deposited into your savings account from your paycheck. Not only will you not have a chance to miss the money, no more effort is required on your part to save.

#4 Create a plan for your debt.

If you have debt, especially high-interest bearing debt like credit cards and personal loans, you are hindering your financial success if you don’t have a plan for paying them off. You may be mindlessly paying the minimums, hoping your situation will change and you can pay more later. You may be waiting for a change forever. Instead of waiting for a financial blessing, or thinking you make a lot of money and you can handle it later, create a plan right now!

Use your budget to see where you can cut back so you can contribute more than the minimum to your debts. If you look at your current statements, your lender discloses how long it will take you to pay your debt off and how much it will cost in interest if you only pay the minimum.

It also discloses how contributing just a little more can reduce the amount of time and interest you pay. Don’t believe me? Just look at your statements! Read the fine print on the pages after your current cycle information. That alone should inspire you. Who wants to give more money to lenders than necessary?

#5 Keep your spending below your earnings.

This may seem like a “duh” statement, but it needs to be said. One of the ways financially successful people stay financially successful is because they spend less than they earn. It’s a very simple concept that isn’t so simple to follow. We want to travel. We want to have a nice pair of shoes. We want to get our friends nice gifts. All of these “wants” add up. In fact, they add up so much that you run into debt to afford it all.

Use your budget to tell you what you truly have left to spend after all of your expenses are covered. If it’s only $100/month, don’t spend more than $100/month on discretionary items.

If you want to take a trip, save that $100 every month until you have enough to cover the trip. You don’t want to charge the trip on your credit card and say you’ll pay it off later. The reality is, that later may be a lot longer than you think and it will cost you a lot more than if you had saved and paid it outright.

#6 Maximize your savings with a high-yield interest account.

You’ve heard me talk about online savings accounts before. If you haven’t, read The Skinny on Online Banks before moving forward. If you are saving money every month (even if it’s not a lot), it should be saved in a high-interest bearing account. Just like credit card companies charge interest for using their credit lines, banks pay interest for those who keep money in them.

Why an online savings account instead of a normal savings account? The reason why is because you earn significantly more interest with an online savings account. That means that every month you are earning more just by having your account somewhere else. Why wouldn’t you want to make more on money that’s just sitting there anyways?

#7 Start investing, even if it’s not much.

Guess what? You don’t’ need a lot of money to start investing. Contrary to misconception, investing can happen with very little cash initially. To make the most of it though, you’d want to transfer $50 a paycheck into your investment account. Check out the article 3 Apps to Help You Save More for two great apps that take your chump change and invest it for you.

Also, consider a discount brokerage firm or investment company like Betterment or Wealthfront. With very low management costs and slim transfer requirements, anyone can afford to start investing. I will say that investing should happen after steps #1-5 are mastered. Read The Beginner’s Guide to Investing with Little Cash for more information.

#8 Set your financial goals.

What do you want out of life? All of the hard work that comes with saving and budgeting has to be for something, right? Maybe you want to own two homes. Maybe you want to send your kids to college so they don’t need student loans. Maybe you want to travel whenever you want. Whatever your reason is, write it down! Set your financial goals and plan them out!

Not only will financial goals help keep you motivated, if mapped out properly, they will tell you when they can be achieved. “A goal without a plan is just a wish”. Make sure you have a plan for your goals, and don’t stop until you have achieved them! If you want to master saving money so that you can reach your financial goals, you’ll love the Money Management Mastery program!

Related: 5 Daily Habits for Financial Success

Ok, there you have it! 8 basic principles that can set you up for financial success. You don’t have to rush into them all at once. Start with #1 and work your way through the list. Don’t procrastinate your financial success any longer. You never know what the future holds, so putting yourself in a position to succeed right now is your best bet!

Are you currently working on any of the principles above? What’s stopping you from doing any of the items on this list? Leave a comment below to share your thoughts and questions!