For most of us, retirement seems like a lifetime away. So, why worry about it now, right? Wrong! Now is when you should be worrying about it! You have your whole life ahead of you, but don’t you want to be able to enjoy life after work? Imagine if you didn’t have any money in retirement, how could you afford to retire? The CGS Team is sharing 7 reasons why you should avoid waiting and start saving for retirement now.

Save for Retirement Early because…

Reason #1: The younger you are when you start saving, the more you will have when you retire.

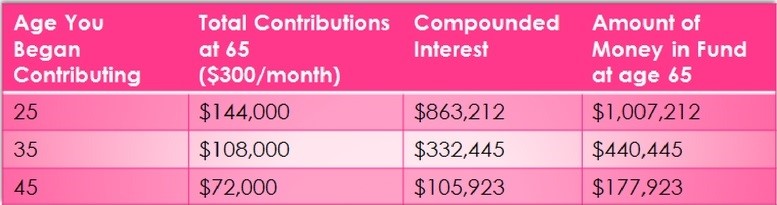

The funny thing about saving for retirement is the younger you are when you start, the more you will have when it comes time to retire. Not simply because you have more time to save, but because your earnings have more time to make money on top of themselves! I’m going to show you an interesting chart. If you’ve read some of the other Retirement articles from City Girl Savings, then you’ve probably seen it. A little reminder never hurts!

This chart proves my point. As you can see, a person who starts saving at age 25, as opposed to 35 or 45, will have up to 10x more in their retirement account. This is assuming a historical growth rate of 8%. Your portfolio could make more! The numbers don’t lie.

Reason #2: The longer you wait to save, the less you will have at retirement.

Another thing you may notice from this chart is that while a 35 year old contributes about $34,000 less than a 25 year old, their compound interest earned and ending retirement amount are less than half of what they could have had if they started earlier. The scenario is much worse for someone who doesn’t start saving until $45.

To make the same amount of money as their younger counter part, a 35 year old and a 45 year old will have to contribute much more than $300/month. They will be using their own money, instead of letting compound interest work for them. They will also have a lot less time to work with, making it harder to ensure they have what they need come retirement time.

Reason #3: You don’t want to rely on Social Security.

According to the Social Security Administration, on average, social security only makes up about 38% of a person’s retirement income. If social security is your only hope, you will have 62% less than what you need to live comfortably during retirement. There’s nothing wrong with taking advantage of the welfare options available to you, but really think about how that will impact the life you want to live at retirement.

Reason #4: You don’t want to rely on your children.

Another bad spot to be in is being forced to live with your children because you don’t have enough money to live on your own. The average life of a mortgage is 30 years. If you wait until you are in your mid to late 30s to buy a home, or you refinance and extend your loan life, you may be paying a mortgage during retirement. Relying on social security and a small retirement plan will make it very difficult to maintain the lifestyle you had while working.

You may be forced to live with your children or rely on them for financial assistance. No parent wants to do this, especially if your children have their own kids to take care of. Avoid relying on other people so late in life by saving for retirement as soon as you can.

Reason #5: Who knows what the future holds.

Who knows what the economy (or world, for that matter) will look like when it comes time for you to retire. Inflation will continue to increase the cost of living over time, and tax rates will probably change a great deal. Government programs like social security, Medicaid and other assistance programs may retire or be replaced.

You never know what the future holds, but even if you did, you can’t change the outcome of things out of your control. The one thing you can control is you and your actions. You can control saving for retirement now or waiting. You can control how much you do or don’t contribute each month. Since this is the only thing in your control, do the right thing for your future.

Reason #6: Your money would benefit you more in a retirement account than anywhere else.

Since the opportunity to make more over time is so great with retirement savings, can you think of a better place to put your money? You could invest in the stock market, but that can get complicated and expensive with extra taxes.

Your money would be more of a benefit to you if it’s in your retirement account. Ask yourself what you would really be doing with it anyways? If you didn’t contribute $300/month or $150/paycheck, where would that money go? If you can’t think of a good enough place for it, then your retirement account is the best option.

Reason #7: You can get free money for saving for retirement.

Since most employers offer some form of match to employees who contribute to a retirement plan, you can get “free” money just for saving for retirement. You will notice that free is in quotations because there are some stipulations. Your match may come instantly, but you may have to be with the employer for a certain period of time before it truly is yours – this is called a vesting schedule. If you leave before you become fully vested, you don’t get to keep that money.

Related: 8 Things to Know about Your 401k Plan.

I hope that I’ve convinced you of the importance of saving for retirement as soon as possible. If you remember anything from this article, remember this: the sooner you start saving, the more you will have. If you think you can’t afford to save for retirement, take a closer look at your budget, or have a professional help. We provide personalized budget plans to our clients so they know exactly what they can afford to save.

Are you currently saving for retirement? If not, what is holding you back? If so, what inspired you to get a jump start on saving for retirement? We would love to hear your thoughts on this subject, so leave a comment below to share!

1 thought on “7 Reasons to Save for Retirement Early”

I started contributing to my retirement plan at 21 (7 years ago) and I’m blown away by the value of it now. I can’t wait to see how time and compounding growth helps in another 7 years. I hope I’ve stressed the importance of starting early!!