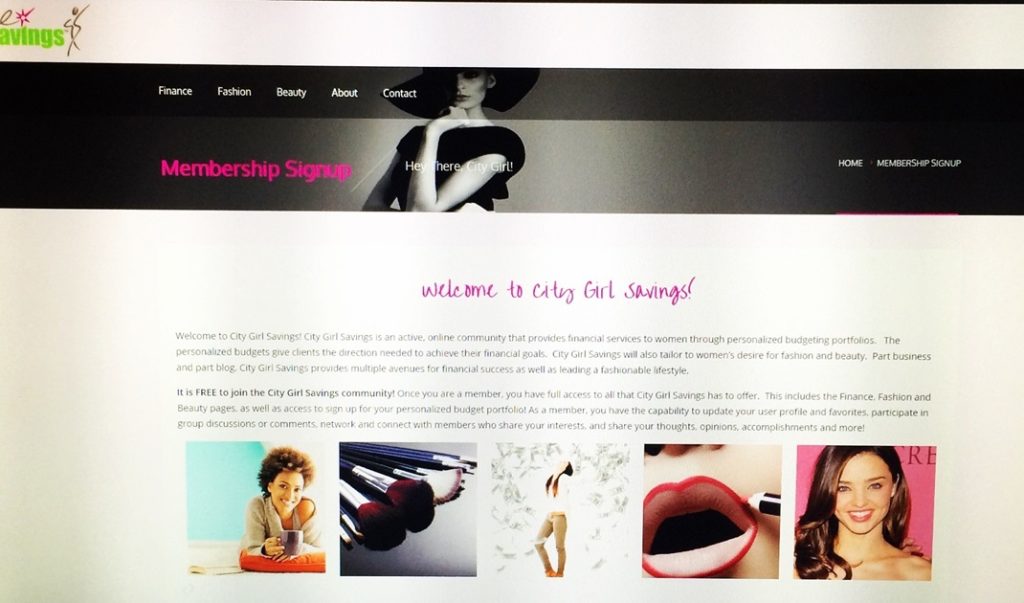

10 years ago today, City Girl Savings launched! I had come up with the idea for City Girl Savings near the end of 2013 and started taking action all through 2014. I hired a company to design a website with the capability of fostering a community, technology to allow me to create customer budget plans through the website and hold a plethora of blog articles.

My mission at the time was to help show women they could live a life of fashion, travel and self-care while reaching money milestones through budgeting. That website was a site for sore eyes, but on January 1st, 2015, City Girl Savings came to life.

As we reach the 10-year anniversary of this wonderful company, I want to share what 10 years in business has looked like for City Girl Savings. I’ve learned a lot over the past decade and I’m reflecting on the growth, the changes, and the lessons learned after 10 years in business.

Let’s start with growth

I wish I could tell you that City Girl Savings launched and was an instant financial success – I mean, we see it all the time on Instagram. People start businesses and appear to make 6 or 7 figures within a couple of months. That was not the case with City Girl Savings.

City Girl Savings may have launched on 1/1/2015, but the first sale came 8 months later and only after offering to create a free budget plan for someone in exchange for a review. My budget plans were $9.95 back then (crazy, I know because of how much work went into them).

I created a budget plan and got the review from the customer. She tweeted something along the lines of “Just got my budget from @citygirlsavings, I’m going to save so much money. Get yours today”. That changed the game. I ended up advertising her tweet on LinkedIn and got back-to-back sales – making just under $90 in 2015.

Because my revenue starting point was so low, I had big jumps the next couple of years. I hit my first 5-figure year in 2018, and that was the year I decided I really wanted to make something out of this business. I doubled the revenue the following year. It took CGS 6 years to finally reach 6 figures – a milestone that people seem to praise on the internet. Not only that, but it also took me 6.5 years to be able to leave corporate America and run CGS full-time.

I certainly wouldn’t call that an overnight success.

We hit six figures again in 2022. Unfortunately, we saw a significant decline in revenue in 2023 – most of you know, that’s the year my mom’s health went south and she ultimately passed in August of 2023. I couldn’t give the business my full attention for most of the year. I’m proud to say that we got back on track revenue wise in 2024.

In addition to revenue growth, I want to talk about other ways CGS has grown through the years.

We started with 0 followers, 0 community members, and 0 newsletter subscribers – basically nothing.

Now we have 48000 IG followers, almost 10,000 newsletter subscribers, 8000 FB Group members and our community keeps growing on TikTok, YouTube and Pinterest. We also have 4 additional team members, outside of me! If you want to meet the CGS team, check out City Girl Savings Podcast Episode #77: Behind the Scenes of the CGS Team.

CGS has partnered with numerous brands, has been featured on a handful of reputable media outlets and I’ve done multiple speaking and teaching engagements. CGS has grown in so many ways from 10 years ago and while I still think there’s a lot more growth to be had, I want to acknowledge how far this company has come. All starting with my fingertips. I’m so proud of this company and truly feel I’m living in my purpose with the work we do.

Let’s talk about lessons learned after 10 years in business!

There are PLENTY of lessons I’ve learned, challenges I’ve faced and hard decisions I’ve made with City Girl Savings. Business ownership requires critical thinking, action taking, and trusting your gut – all things that aren’t easy all the time.

Lesson #1 – CGS isn’t for everyone

While I do believe everyone needs financial education and money management skills, I’ve learned that not everyone needs CGS for that. Some people aren’t a good fit as clients. Some people don’t agree with our approach to budgeting and goal setting. Some people don’t see value in paying for CGS services.

You know what? All of that is 100% okay and it took me a while to learn and accept that. I used to want to serve everyone and that’s just not realistic. The right people for CGS get the right things from CGS.

Lesson #2 – Things are going to change, and that’s a good thing

What I thought City Girl Savings was going to be in the beginning, and what it has turned out to be now are two totally different things. My website has changed. My business model has changed. My pricing has changed. My branding has changed. My clientele has changed. Almost everything is different from 2015.

But guess what? That’s also 100% okay. In fact, it’s more than okay. Because I have been open to change the whole time, things have worked out in ways I wouldn’t have imagined. Because I have been open to change, my true path has been made clear to me.

I think being a business owner who’s gone through change has made me a more flexible person – I still have rigid tendencies (typical of a Type A Virgo), but I’ve grown to be much more fluid and flexible with a lot of things in life, not just business.

Lesson #3 – I can’t do it all, but no one will love it as much as me

I’m so blessed to have the help I currently have with City Girl Savings. Lena, Brittany, Mariel and Taelor – you all are amazing. I can’t believe there was a time when I thought I could do it all. Maybe because I did it all by myself for so long; even as the business grew AND while working in corporate full-time.

I didn’t have to work that hard. I could have brought in help earlier to ease my workload, but I didn’t and I hit burnout a few times. Hindsight is 2020! Now, I’m more than happy to take things off my plate and allow others to help me – especially if it’s taking things off my plate that I’m not good at or passionate about but the person receiving that workload is!

Just because I let go of the responsibility doesn’t mean I let go of the oversight. I can always see what’s happening, even if I’m not in the weeds. Letting go of tasks that weren’t helping me get to the next level was such a game changer. It allowed me to focus on the things that help move my business forward. It also freed up time on tedious tasks and helped provide more financial security for someone else!

While I’ve learned that I can’t do it all and it’s okay to let go of responsibility, I’ve also learned that no one is going to love CGS as much as I do. It’s not anyone else’s baby; it’s mine, so that makes sense. However, you don’t automatically think that. You think everyone is going to push their own boundaries for the business, and that’s not realistic (nor healthy). It’s taken me time to recognize this, but I think it’s made me a more open-minded individual and hopefully a better leader.

Lesson #4 – Don’t focus too much on what others are doing

I’ve always been pretty good about following the beat of my own drum. If I want to do something, I usually do it. I don’t see what others are doing or how they’re doing it. I go forth my own way. It’s served me well. But I will say that it was much easier in the early years of CGS to be that way, because there weren’t a lot of money coaches or financial influencers. That changed in 2020 – likely because of COVID.

There was a huge surge in financial education content, social media accounts and money coaches. Some of those accounts grew at lightning speed – way past City Girl Savings and in a shorter amount of time – I did (and continue) to do my best to not focus on that. It’s not something I can control, nor does it change what I’m supposed to be doing.

More competition may mean less client options, but I’ve never not had clients, and I know that the people who become my clients are meant for me. That’s such a great feeling. It’s easy for anyone (not just business owners) to play the comparison game, but it serves no positive purpose.

Finding the right words…

It’s hard for me to articulate the growth, the lessons learned and all the changes City Girl Savings has endured over the past decade, but I hope I did it some sort of justice. This company, this business, it’s so important to me and it’s so important for the people who truly need the information and the encouragement to change their financial lives. If I had to do it all over again, I would…in a heartbeat.

I hope the next 10 years of CGS sees even more growth, lessons learned and lasting community impacts.

I want to add that if you have been wanting to work with someone to improve your financial situation, and think I may be that person, request a call with me and let’s talk. It’s a complimentary 30 minutes with no requirements other than showing up the day of our call.

I also want to add that if you have a business idea, want to provide a service, or want to start an online coaching business, I have a business mentoring and coaching program that can help.

Related: CGS Podcast Episode #119 – How I Grew My Business While Working Full Time in Corporate

Whether you’ve been with City Girl Savings from the beginning or found us more recently, thank you for your attention! Thank you for being a follower, community member, and/or client. It means so much to this small business who’s trying to make a big impact. Do you have any questions about CGS? Feel free to drop a comment below to share!