Long gone are the days where self-care is simply seen as a beauty routine, a bubble bath, or a monthly massage. In 2025 and beyond, self-care is more than caring for your body in the present. Self-care is caring for your ultimate well-being, now and in the future. That includes your financial well-being! When it comes to self-care, instead of only thinking spa days and yoga classes, think of self-care as securing your financial future.

When you think of self-care in those terms, you’ll understand that investing your money is one of the best self-care moves you can make. You’ll be making that move in the present, with the ultimate rewards being reaped in the future.

Many millennial women prioritize their present comfort but neglect financial habits that support their future. I’m not saying you can’t be comfortable in the present, you definitely can. I’m just saying we also have to prioritize our comfort in the future. Investing is one of the best ways to do that! In this article, I will show you how investing is the ultimate form of self-care and why you should start now!

Why Investing is the Best Self-Care Move for Your Future

First, Redefine Self-Care to Include Financial Wellness

Often, when we think about self-care, we think about traditional means of caring for ourselves. Doing things that help prioritize our mental and physical health. Making sure we take time for ourselves and do things that help us look and feel the best we can.

Here’s the thing, though…finances play a huge role in our mental health. And, if true self-care means reducing future stress, then investing is your hedge against future stress. Investing in the present is a form of security in the future. Investing gives you the opportunity to retire in your later years and feel confident that you’ll be able to financially survive.

Not only that, investing itself aligns with long-term security. For women, financial independence is huge. Achieving life goals is huge. Investing is what makes those things possible. It’s one of the best ways to build real, lasting wealth over the course of time.

Investing Builds Wealth Over Time

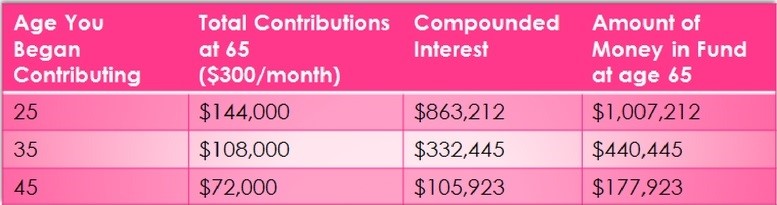

Let’s elaborate on this, because it will truly show the power of investing. Look at the following chart:

These numbers are based on an 8% rate of return. The person who starts investing at 25 will be a millionaire by the time they retire. Not only that, but they’ll have earned significantly more in compound interest than the person who started at 35 or 45.

If you take anything away from this article, let it be this. Compounding interest returns are the highest when you start as early as possible. The later you start, the more you’ll need to regularly invest to see the same type of gains. With the cost of living constantly rising, it can get harder and harder to invest larger amounts as time goes on.

Knowing that your money is working for you and working to secure your future self helps to reduce stress and anxiety and builds confidence in your ability to take care of yourself. That’s a form of self-care that’s worth working towards!

It Helps You Achieve Life Goals

I think another often-overlooked form of self-care is setting and achieving goals. As a woman, it’s so empowering to know that you’re capable of working hard and getting the results you want. When you need money to reach your goals, investing can help you get it!

Think about your life goals; your long-term goals. These are goals and aspirations that truly matter to you. Things like buying a forever home, retiring early from the workplace, traveling on a regular basis or being able to financially support your loved ones (parents or children). When you identify the goals that matter, you can then tie investing outcomes to them. This gives meaning to investing and makes it worth the effort.

It Protects You Against Uncertainty

Let me make something clear, if it’s not already. The purpose of investing is to see compounding growth. The best way to do that is to keep your investments funded and intact for as long as possible. Unfortunately, life doesn’t always go the way we intend. Sometimes, we need to tap into those investments to help us – whether it’s to achieve a goal earlier than planned, to cover unexpected life events (like job loss or health issues), or to help a family member in need.

Your investments can protect you from uncertainty and ensure you can financially survive something coming up unexpectedly. This is a form of self-care because you now have peace of mind knowing that you’re prepared for whatever may come your way.

I also want to add that investing is one of the best ways to protect yourself from inflation. High yield savings accounts are great, but 3-4% returns aren’t nearly as impactful as 8-10% returns. No one can afford to avoid investing.

It’s Easier Than You Think

Think of the last skill you mastered. There was a point in your life when you knew very little about the skill. Now, that you’ve mastered it, you’re confident in your ability to execute. Well, investing is a skill that can be mastered…and it’s not as hard as society makes it seem!

There are so many ways a person can get started with investing that don’t require a lot of money or a lot of risk. Beginner-friendly apps like Acorns, Robinhood and Betterment make it easy for anyone to get started. Even $25/month can have a huge difference over time.

Not only that, you may already be an investor! If you have a retirement plan, like a 401k or an IRA, then you’re already investing. Funds in those accounts are automatically placed into investments. You may not know what they are or what they mean, but guess what? You’re still investing! Doesn’t that thought make you feel better?!

While anyone can get started with investing at any time and with any amount of money, it’s still important to expand your knowledge on the subject. Knowledge is power. The more you know, the more confident you’ll feel. Pick up a few books on investing. Listen to some podcast episodes from investors. Check out the Investing articles on the CGS blog! The information is out there, you just have to seek it.

Investing Supports Your Independence and Legacy

Financial independence is a form of self-care. Investing allows you to make life choices without financial constraints. Being able to do what you want, when you want and not having to worry about affording it is incredibly gratifying. The more you invest, the longer you invest, the more financially independent you’ll become.

Investing will also allow you to build generational wealth. Funds invested for the long haul can leave a legacy behind for your family or the causes you care about. Investing gives you the ability to create impact beyond your own life. That’s very empowering to think about.

Related: Top 5 Tips for Women Who Want to Invest

When you start to see investing as a form of self-care for your future self, you’ll understand that it’s so much more than about making money. It’s a way to make sure your future self is comfortable. What better way to take care of yourself?! Thankfully, you don’t need to be an expert to get started with investing. Check out CGS Podcast Episode 107 – Adding Investing to Your Money Goals with Marc Russell of BetterWallet.

What’s one life goal you’d like to invest in for your future? How can you start prioritizing self-care via investing today? Drop a comment to share your thoughts!

-Raya

The CGS Team