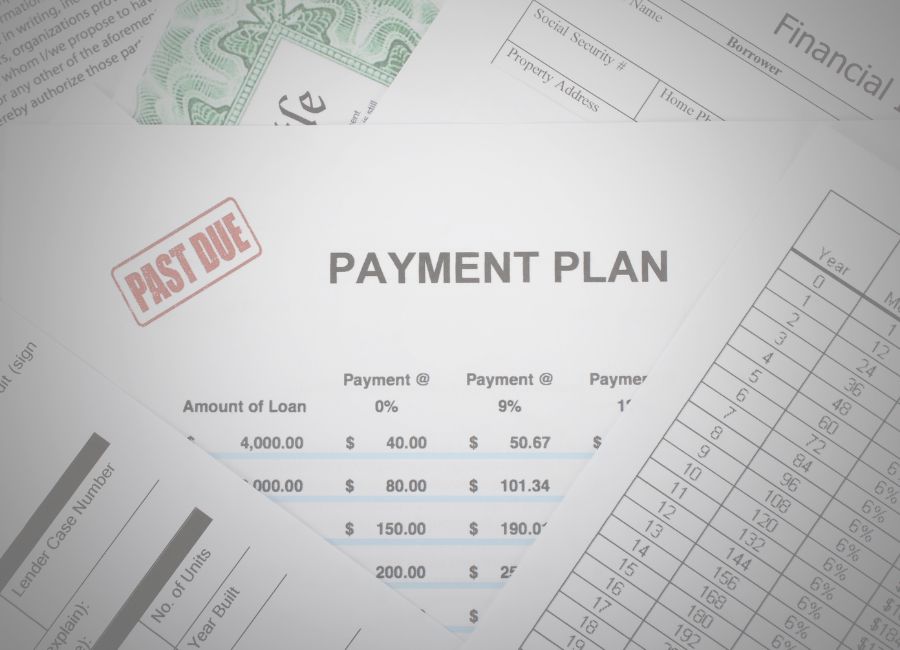

Be real with me…how many Klarna, Affirm, or PayPal payment plans have you set up? In fact, how many of them are you currently paying on?! Buy now, pay later sounds great in theory, but if we pull back the curtains, all that glitters isn’t gold. $30 payments every 2 weeks sounds affordable, but when you have 5-10 of them, these buy now, pay later plans can wreak havoc on your budget.

What’s worse is while you may start with $30 payments, it’s only a matter of time before you dabble in the $60, $150, and $200 payment options. It can be addictive. It can also force you to keep taking these payment plans out because you have no choice but to rely on them for purchases! I want you to avoid that financially detrimental trap. I’m sharing 5 reasons to avoid buy now, pay later plans so you can take back control of your budget.

5 Reasons to Avoid Buy Now Pay Later (BNPL)

#1 It Encourages Overspending

One of the most vital reasons to avoid buy now, pay later is the fact that it encourages overspending. Not only does the brain see the upfront/payment plan cost as the only amount needed to spend, but it rationalizes making payments for something that should be paid for in full (or not paid for at all).

BNPL makes expensive purchases seem more affordable. You’re not focused on the full amount of the item, only the amount you need to pay for in the moment. Combine that with the easy approval process and it’s way too easy to impulsively buy something. In fact, it’s way too easy to justify making the purchase, even if you aren’t impulsively buying it!

Don’t fall into the thought process of “it’s just $30 every two weeks; I can make that work.” Do it once and it’s much easier to keep going.

#2 It Creates a Never-Ending Debt Cycle

Once you see how easy it is to leverage buy now pay later to purchase things you wouldn’t be able to afford in full (or shouldn’t be purchasing period), the dangerous cycle begins. You constantly justify your BNPL purchase and then you start doing these types of plans for other purchases. One, because it’s so easy and two, because you don’t have as much money in your accounts anymore!

These small payments add up quickly, which makes it harder to get ahead. Then, it forces you into needing these types of payment plans to afford things you actually need. This is what will keep you in a never-ending cycle of debt. Only, it doesn’t feel like debt because you may not have the same stipulations as a typical credit card debt has.

BNPL also gives consumers the option of rolling over payments into new purchases. That means you’re never really paying anything off – you’re just rolling into the next payment plan! This puts you at risk of always having (or worse, needing) buy now, pay later obligations. That will make it significantly harder for you to become financially free.

#3 It Messes with Your Budget

I’ve worked with a handful of women who’ve gotten sucked into the BNPL cycle and when they actually list out all of their Klarna, Affirm and Afterpay accounts, they are shocked to see just how much they spend every month on those plans. BNPL messes with your budget in ways much worse than credit card debt. Sometimes, these payment plans require bi-weekly payments, which add up over the course of the month. Essentially, throwing your monthly budget off.

Not only that, you MUST be diligent with tracking all of your buy now, pay later payments. Depending on how many you have, it may be hard for you to keep tabs on everything. Between different pay schedules and frequencies, forgetting one payment could mess up your entire budget.

If your bank charges fees for over drafting, your BNPL may cost you more than just the payment plan amount. Forgetting a payment could result in you not having enough in your bank account to cover the cost, and now you’re hit with fees and penalties. If you budget your money down to the wire, this type of scenario could result in a lot of financial stress and extra money going out.

#4 It Can Impact Your Credit Score

Did you know that some BNPL services report late or missed payments to the credit bureaus?! That means you could have negative impacts to your credit score when taking on these kinds of payment plans. You may not be charged interest, but these types of plans seem to function just like most other debts.

In addition to being reported late, any BNPL account that’s reflected in your credit could result in a higher credit utilization percentage. This could be a red flag for lenders – both for current and future credit accounts. Since some of these BNPL plans function as forms of credit, you have the potential to see a lower credit score if you do pay late or overuse these plans.

#5 It’s a Temporary Fix, Not a Long-Term Solution

Let’s be real with each other. Buy now, pay later options are tempting because they allow you to make purchases in the present (instant gratification) that you can’t really afford. While you may get that dopamine hit when you make the purchase, it exacerbates underlying financial issues. If you struggle with impulse spending or the desire to accumulate things, BNPL makes it easier for you to continue this bad behavior.

Relying on payment plans, instead of saving for your purchases, is a temporary fix for a long-term problem. It keeps you stuck in the cycle of always needing a payment plan because your income is already allocated to other payment plans! It also encourages a mindset of “buy now, worry later”, which is dangerous when trying to make financial progress.

Related: 4 Loan Types to Tread Lightly With

After hearing those reasons to avoid Buy Now, Pay Later plans, I think it’s safe to say that these plans are more of a financial trap than a financial convenience! I’m not saying they can’t be managed, but it’s a slippery slope. If you’re stuck in the cycle of paying them off currently, stay the course. Do your best not to take out anymore – learn to rely on your budget for purchases, even if that means saving money for a few pay periods before making the purchase.

We’re all worthy and capable of taking back control of our financial situations! Do your best to put the power back into your hands. Have you fallen victim to BNPL plans? What was the experience like for you? Drop a comment below to share!

-Raya

The CGS Team